Budgeting is an essential part of financial planning. Without budgeting, it is impossible to achieve financial goals. Everyone should have a proper budging plan so that we can manage our financial resources well. Many people don’t even know from where the money is coming and where it is going. In 2022 a survey conducted by the lending platform OppLoans revealed that 73% of Americans don’t budget. In our article “Taking Control of Your Finances With Budgeting Basics” we’ll be trying to cover all points of the budgeting basics and the process of making a budget so that you can take control of your finances.

(Image Source: istockphoto.com/ Illustration: wisenewsblog.com)

1. What is Budgeting?

Budgeting is making a plan to manage your money. This plan involves the efficient allocation of funds to your different expenses to achieve a financial goal. With the help of budgeting, you can track your expenses and spending and can identify the area where you can save money by avoiding overspending.

A budget should include your income through all sources and fixed and variable expenses. you should track your progress from time to time to ensure it works for you and make adjustments as needed.

Budgeting helps you to stay focused on track and achieve your financial goals.

👉Read more: Strategic Asset Allocation | The Ultimate Key to Wealth Creation

2. Developing A Good Budget Plan.

To Take Control of Your Finances With Budgeting Basics, Budget development is an important and crucial step to achieving your financial goal. In this step, you have to develop a basic budgeting plan that would work for you. Make a budget plan keeping your own requirements and financial goal.

Always remember your budget is your budget, it’s not your colleague, it’s not your friend or neighbor. Here we discuss a step-by-step process to give you an idea that how to develop a budget.

-

Understand Your Net Income.

In this step, you have to identify your all resources of income and calculate your monthly net income which includes your wages, income from investments, or any other sources of income.

-

Understand Your Expenses.

In this step, you have to identify your all fixed and variable expenses. Fixed expenses are those which don’t change month to month like your house or car EMI, Debt payments, etc, and cannot be avoided.

Variable expenses are those which may change month to month like grocery, entertainment, gas, etc. This will help you to track your spending more accurately and help you to make a plan for unexpected expenses.

Record your daily spending on paper or in a works sheet or on the smartphone as many apps are available for this purpose these days.

-

Understanding the Difference Between Needs and Wants.

In the starting point of making a budget, you should understand the difference between needs and wants so that priority for the allocation of money can be done.

Needs cover things that are your essential expenses and cannot be avoided like food, clothing, rent, etc.

Wants to cover those spendings which are not essential and can be avoided like entertainment, eating in a restaurant, etc.

-

Set Realistic Goals.

The basic purpose of budging is to achieve financial goals. But to achieve the goal you first have a goal. Always set financial goals which are realistic as per your present financial conditions. There are mainly Two types of goals long-term goals and short-term goals.

Long terms goals are those goals that can take a long time to reach like your retirement goals or child education etc.

Short-term goals are those goals that should take time one to three years to achieve like setting up an emergency fund or paying down credit card debt.

3. Making a Budget Plan.

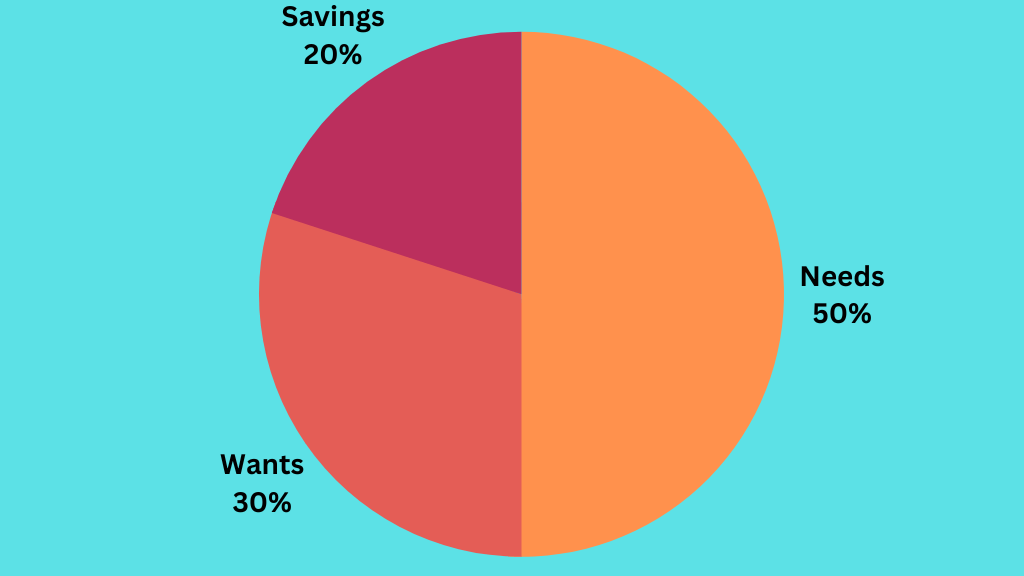

Now you have understood your all income resources and expenses and have set your goal. Now you have to put together all these things and make a good budget plan for yourself. for this, you can follow some simple well-tested budgeting frameworks like the 50/30/20 rule.

This rule was described by Senator Elizabeth Warren in her book, “All Your Worth: The Ultimate Lifetime Money Plan.

According to these rules, 50% of your income is allocated to your needs.

30% of your income is allocated to your wants.

20% of your income is allocated to your saving or debt payment.

It is important that your budget plan should cover your all needs, and wants and also your savings for emergencies.

4. Take Advantage of Technology for Taking Control of Your Finances With Budgeting Basics.

We are living in a technology era so why not we can take the help of technology to create and execute an effective budgeting plan.

A cash flow worksheet can help you to visualize your budget and track your income and expenses and helps to identify overspending areas where you can save money.

There are a variety of budgeting software and apps available to help you to keep track of your spending and savings. These tools help you save and manage spending habits. These tools automate your savings so that you will not face low cash problems saving funds.

5. Tracking Your Progress.

Tracking of reviewing progress is an important part of basic budgeting. once you have made a budget plan it is important to track your progress on a regular basis to ensure it works for you.

If your financial situation got changed then make sure to do the necessary adjustments as per your current financial situation.

Tracking your progress can also helps in the identification of areas where you can save more and motivate you to stay on track to achieve your financial goal.

Conclusion.

Budgeting is a great way to take control of your finance and achieve financial goals. It involves the identification of your all income sources and expenses and making a good plan to achieve realistic financial goals. It is recommended that you should also track your progress on a regular basis which can help you to stay motivated.

By following these budgeting basics you can control your financials and achieve your financial goals.

👉Read More: Secrets of the Millionaire Mind

FAQs

-

How Do You Take Control of Your Budget?

Controlling the budget is a very important part of life to achieve a financial goal. You can take control of your budget by making a good budget plan for yourself.

-

What are The 3 Basics of Having a Budget?

First, identify your all sources of income. second, identify your all expenses, and third one is set realistic goals. So that you can make a good budget plan for yourself.

-

What are the 5 Budgeting Basics?

- Calculate your net income

- Calculate your net Expenses.

- Set Realistic Goal

- Use Automatic Tools

- Track your progress.

-

What is The First Step in Taking Control of Your Finances?

The First Step to taking control of your finance to understand the concept of budgeting. Budget development is an important and crucial step to achieving your financial goal. In this step, you have to develop a basic budgeting plan that would work for you. Make a budget plan keeping your own requirements and financial goal.

-

What are The 5 Finance Rules?

- Create an alternate income source

- Always spend less than your income.

- Make a good Budget Plan.

- Plan For Emergencies.

- Plan for retirement.

-

How to Learn Financial Basics?

There are several ways to learn financial basics including online Tutorials, reading financial blogs or articles, and reading financial journals and books to Taking Control of Your Finances With Budgeting Basics. You can also take in-person financial classes via both online or office line mode etc.

8 thoughts on “Taking Control of Your Finances With Budgeting Basics”