If you are a beginner in investing or you don’t have time to track the stock market on a daily basis but really want to participate in the growth story of the stock market then you should initially go with strategic asset allocation. Strategic asset allocation is a target-based portfolio technique that includes various asset classes like stocks, bonds, cash, etc. This article will give you a complete quick guide on strategic asset allocation, its benefits, the process of implementation, and many more.

1. What Is Strategic Asset Allocation?

Strategic Asset allocation is a long-term portfolio-building strategy whereby investors choose targeted asset classes and involves periodic rebalancing according to their risk appetite.

In Simple words in this portfolio strategy, you have to determine the percentage of various assets that should be in stocks, bonds, and cash, real estate. Once you have decided upon an allocation, you stick with that allocation for many years.

The portfolio rebalancing required balancing the risk and return when your original allocation weight got deviated. Strategic Asset allocation is a long-term investment technique based on the modern portfolio theory. The two main principles of strategic Asset Allocation are:

- Diversification of portfolio

- Reduced Risk with good returns

👉Read More: What is Equity in Business and Why Does It Always Matter

2. Strategic Asset Allocation Example.

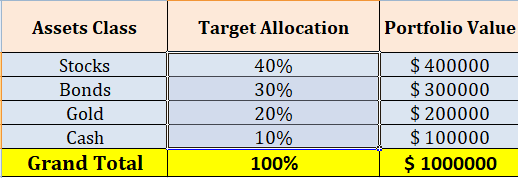

Let’s try to understand this strategy with an example. Suppose Mr. James has a portfolio with a value of 1 Million USD and he wants to follow a conservative approach so he decides to target the allocation of 40% to Stocks, 30% to bonds, 20% to gold, and 10% to cash. His time horizon for this strategic Asset allocation for 5 to 10 years and his portfolio looks as follows:

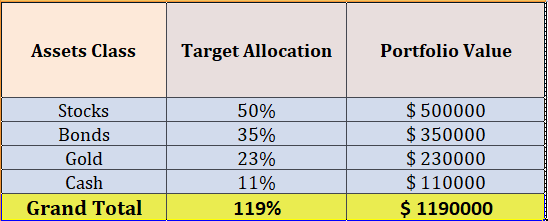

Assume after one year his stocks portion generates 10%, Bonds generate 5%, Gold generates 3% and cash generates 1% returns than his current portfolio looks as below:

As we know, in the Strategic Asset allocation strategy, Mr. James has to be strict with his initial allocation, and here rebalancing is required. So He has to decrease the 10 % of shares i.e. $24000 earned from stocks and have to increase the share value by $7000 in bonds, $8000 in gold, and $9000 in cash selling profit that he has earned from stock in a year to achieve initial targeted allocation (i.e. 40% Stocks, 30% bonds, 20% gold and 10% cash). After rebalancing his portfolio looks as follows:

3. Understanding Factors Affecting Strategic Asset Allocation.

It is a traditional approach to building a long-term portfolio with the buy-and-hold strategy and is purely based on the needs and preferences of the individual.

The goal of such type of asset allocation is to generate the maximum returns with low risk. There are several factors that affect Strategic asset allocation and we are going to explain them one by one.

- Risk Tolerance:

By now you must know that in this strategy while building a portfolio by allocation of various asset classes. This allocation of asset classes actually depends upon the individual risk appetite.

For example, an investor of higher risk tolerance put more allocation of his investments into stocks instead of bonds. Whereas low-risk profile investors don’t like the volatility of the market and would like to allocate more investment into low-risk asset classes like bonds.

- Time Horizon:

The second factor affecting strategic asset allocation is your investment time horizon which means how long you can stay invested.

A longer time horizon makes better returns as one can average out the market’s volatility over a long time.

It has been seen that a person with a longer time horizon does more allocation in stocks to get more returns, on the other hand, a person with a shorter time horizon prefers less allocation to stocks and has a low-risk attitude.

- Investing Objective:

It means your expected return from your portfolio is the third factor that affects strategic Asset allocation. For example, if you expected a low return like 6% from your portfolio with low risk then you have to allocate more weight to low-risk assets classes like bonds or cash, or if you are looking for a high return like 12% then you have to allocate more weight to high-risk high returns asset like Stocks.

4. To Whom Does This Strategy Suit?

- New Investors:

This is best for Newbie Investors who want to generate returns from the markets but can’t track the stock market regularly.

- Long-Term Investors:

The Long term investors believe in buy and hold strategy and don’t want to time the market. With this strategy, they can average out the volatility of the stock market in the long term.

- Low-risk appetite investors:

This type of portfolio-making strategy helps to reduce the risk and is good for those who want to participate in the equity market to get handsome returns but with minimum risk.

5. Benefits.

- This strategy is beneficial for amateur investors who want to invest in Equity markets with calculated risks.

- This strategy helps those who believe in buy and hold technique and generates full fruit returns in long term.

- This is beneficial to make a portfolio for an individual level to meet goals as per individual desire.

- It is a type of passive portfolio diversification management and is easy to manage as it does not require daily bases modification of portfolio assets.

- It is a fixed investment portfolio for low-risk tolerance investors.

- It required reallocation only when the allocation is dis-proportioned to its initial weight.

6. How to Get a Strategic Asset Allocation?

In four simple steps, you can make your portfolio by applying this strategy:

- Risk Assessment:

In the first step, you have to identify how much risk you can take on your investments. It is directly proportional to your investment objective to your desired return. If you want a high return without the worry of risk then it means you have a high-risk tolerance profile.

- Understand Investment Horizon:

It is the most important step to investing. A long time horizon helps in averaging the market and reducing your risk whereas a short time horizon increases risk. In this step, you have to understand the duration for which you want to stay invested.

- Broad-based Asset Allocation:

This is the final and most crucial step where you have to decide the percentage (%) funds allocate to which asset class as per your risk profile and time horizon and you have to stick with your target asset allocation for many years as per your decided time horizon. In this step, you may to further analyze that how much allocation you want in Large Cap, Mid Cap, and Small Cap stocks in your stock asset allocation.

- Watching and rebalancing:

Once you have allocated your assets and set a target then you just have to monitor your progress periodically( i.e. annually or Bi-annually) and do rebalancing of your asset classes if their weight changes/deviated from its original ratio which you have decided on starting.

7. Drawbacks of Strategic Asset Allocation.

As we have already discussed that this strategy follows buy and hold principle and generates low-risk returns over a long time horizon. The drawback of this strategy is you have to stick with a particular allocation and over a period of time you have to sell the high-performing assets to buy underperforming assets to rebalance the portfolio.

8. Strategic Asset Allocation vs Tactical Asset Allocation.

Strategic Asset allocation has some disadvantages and if you are an aggressive investor and can actively participate in the market then you should go with tactical Asset allocation. The main difference between both is given below:

STRATEGIC ASSET ALLOCATION | TACTICAL ASSET ALLOCATION |

It is s Passive investment.

| It is an active Investment.

|

It follows need based, goal oriented approach.

| It follows view based, return oriented approach.

|

It involves buy-and-hold strategy.

| It involves frequently trading strategy.

|

It is good for long term time span.

| It is good for mid term or short term time span.

|

It works good for new investors.

| It demand more investment expertise.

|

9. Conclusion.

Strategic Asset allocation is a passive portfolio-making strategy that works on the principle of buy-and-hold. This is good for new investors and requires less effort to manage the portfolio. It helps to determine what percentage of your assets should be in stocks, bonds, and cash. Once you decided on the allocation you have to stick with that allocation for many years and rebalancing is required when changes in asset weight occur. We hope you have liked our efforts and let us know your valuable suggestions if any.

👉Read also: Taking Control of Your Finances With Budgeting Basics

10. FAQS

1. What are Strategic Asset Allocation and Tactical Asset Allocation Strategies?

Strategic Asset allocation is a long-term portfolio-building strategy whereby investors choose targeted asset classes and involves periodic rebalancing according to their risk appetite. Whereas Tactical Asset Allocation is an active management portfolio-making strategy. In this strategy, re-balancing of holdings is required to take advantage of market prices and strengths.

2. How Do You Create Strategic Asset Allocation?

You can create strategic asset allocation by using 4 steps simple process

- Risk Assessment.

- Understand Investment Horizon.

- Broad-based Asset Allocation.

- Watching and rebalancing.

3. What are The Various Asset Allocation Strategies?

There are three main types of asset allocation strategies:

- Strategic Asset Allocation.

- Tactical Asset Allocation.

- Dynamic Asset Allocation.

4. What are The Benefits of Strategic Asset Allocation?

- This strategy is beneficial for amateur investors who want to invest in Equity markets with calculated risks.

- This strategy helps those who believe in buy and hold technique and generates full fruit returns in the long term.

- This is beneficial to make a portfolio for an individual level to meet goals as per individual desire.

- It is a type of passive portfolio diversification management and is easy to manage as it does not require daily bases modification of portfolio assets.

- It is a fixed investment portfolio for low-risk tolerance investors.

- It required reallocation only when the allocation is dis-proportioned to its initial weight.

5. Why is Strategic Asset Management Important?

This strategy is beneficial for amateur investors who want to invest in Equity markets with calculated risks. This strategy helps those who believe in buy and hold technique and generates full fruit returns in the long term. This is beneficial to make a portfolio for an individual level to meet goals as per individual desire. It is a type of passive portfolio diversification management and is easy to manage as it does not require daily bases modification of portfolio assets. It is a fixed investment portfolio for low-risk tolerance investors. It required reallocation only when the allocation is dis-proportioned to its initial weight.

6. What are The Three Asset Allocation Models?

As per the requirement and risk appetite of an individual, there are three types of asset allocation models:

- Income Portfolio: 70% to 100% in bonds.

- Balanced Portfolio: 40% to 60% in stocks.

- Growth Portfolio: 70% to 100% in stocks.

7. What are The 4 Classifications of Assets?

There are basically four types of assets as follows:

Current Assets: These are short-term resources and are expected to convert into cash within a year.

Fixed Assets: These are those resources that have an expected life of more than one year, for example, plants, buildings, etc.

Financial Assets: These refer to the resources of investments like bonds, stocks, securities, etc.

Intangible Assets: Those economic resources which have no physical presence include patents, copyrights, and trademarks.

8. What are The Benefits of Asset Diversification?

The main goal of Asset Diversification is to reduce the risk and get benefits from more than one asset class. The main benefits of asset allocation are as follows:

- It helps full to achieve long-term investment plans.

- It is helpful to get the benefit of compounding interest.

- It helps to reduce the impact of market volatility.

- It is used to get the advantage of different investment instruments.

- It helps to reduce the risk of capital erosion.

- It Reduces the time spent monitoring the portfolio.

4 thoughts on “Strategic Asset Allocation | The Ultimate Key to Wealth Creation”