In the US stock market, NYSE had a combined total of 2,578 listed companies and NASDAQ has 3,788 listed companies. A potential investor has to study various financial metrics to analyze the health of a business before investing and operating cash flow is one of the most important metrics. You may be surprised to know that the Profit and loss statement of the company can’t give the actual picture of the company’s finances but the operating cash flow does. As you progress with this article, you will unlock the secret of cash flow.

1. What is Operating Cash Flow?

Operating Cash flow or OCF is simply defined as the amount of cash generated by a company through its core operation within a specific time. It helps to analyze the actual financial condition of a company.

It indicates whether the company is capable to generate sufficient cash to maintain, run and expand its existing operations.

In simple words, OCF is an important benchmark to determine the financial success of a company’s core business/operations.

OCF generates money through various activities and is also referred to as cash flow from operating activities. These activities include:

- Net sales of goods and services within a specific time.

- Payments to goods and services suppliers or vendors.

- Payouts to the company’s employees and other incurred expenses for productions.

👉 Read More: What is Equity in Business and Why Does It Always Matter?

2. What is a Cash Flow Statement?

The Financial statement which records the operating cash flow metric is known as the cash flow statement. As per accounting standards established by U.S. GAAP, every organization prepares three crucial financial reports at the end of the financial year i.e. Balance sheet, Income statement, and Cash Flow Statement.

The net income statement follows the accrual accounting approach, which means it represents a company’s net income including all types of expenses within a specific period.

Whereas the Cash flow statement follows the cash accounting approach which means it includes only realized revenues and expenses within a specific period of time.

That’s why it is called that cash flow statement gives a real insight into a company’s financials, It is important to note that fundamentally cash flow report is segregated from both the net income statement and balance sheets.

3. How to Calculate Operating Cash Flow?

Till now you have come to know the concept of the OCF and now we will discuss step by step process to calculate it. There are two methods/formulas to calculate OCF i.e. Direct Methode and Indirect Methode.

OCF concentrates on cash inflows and outflows related to a company’s main business activities. The Positive number represents the cash inflow and the negative number ( number in brackets e.g.($12000)) represents outflow cash in the Cash flow statement.

-

Operating Cash Flow Formula (Direct Method).

In the direct method, we use a simple formula to calculate OCF to obtain an accurate result. However, this method doesn’t provide real insight to investors. So it is used mostly by companies to track their operational performance. The Direct OCF formula is expressed as:

“Operating Cash Flow (OCF)= Total Cash Revenues – Operating Expenses paid in cash”

It is noted that in the direct method, only cash revenue and cash operating expenses are included.

-

Operating Cash Flow Formula (Indirect Method).

The indirect method is the most common approach used by ‘potential investors’ to calculate OCF in The United States which gives an actual insight into the financials of a company.

In this method, Net income is adjusted by adding non-cash items to the accounts and also includes depreciation into net income to adjust the changes in cash receivable and inventory.

In other words, the indirect OCF method includes the adjustment of additional non-cash items (depreciation, amortization) into the net income and also tunes out the changes in the net working capital. The In-direct OCF formula is expressed as:

Operating cash flow = Net income + Non-cash expenditure [depreciation, amortization] (+/-) Changes in assets and liabilities [net working capital]

The relationship between changes in working capital items and their relation to cash flow impacts for your better understanding is given below

- Increase in Working Capital Asset → Cash Outflow

- Decrease in Working Capital Asset → Cash Inflow

- Increase in Working Capital Liability → Cash Inflow

- Decrease in Working Capital Liability → Cash Outflow

-

Operating Cash Flow Formula and Example.

As we have already discussed above that In-Direct operating cash flow method is mostly used by the potential investor to analyze a company so here we will try to understand said formula with the help of an example. Suppose that a company named XYZ has the following Financials :

Net income= $ 100 million.

Depreciation and amortization = $ 25 million.

Net working capital increase = $ 15 million.

In the first step, net income is derived from the income statement. In the second step, D&A is a non-cash add-back and has a positive impact on net income. In the third step increase in net working capital means the company has spent cash and has a negative impact i.e. cash outflow. Now by applying the above assumption in the formula, we can get the OCF:

Operating cash flow = Net income + Non-cash expenditure [depreciation, amortization] (+/-) Changes in assets and liabilities [net working capital]

Operating cash flow= $ 100 million + $ 25 million – $ 15 million.

Operating cash flow = $ 110 million.

4. Significance of Operating Cash Flow.

We have already discussed that OCF has great importance to analyze company financials. Many of the new investors only focused on the profit and loss statement of a company but many times profit and loss statements don’t provide the real picture of company financials.

Let us understand it by taking an example. Suppose a company is operating in the paint business and sold 100 paint boxes at the cost of 1 $ per box but for some reason is unable to get payments in a financial year.

In this particular scenario, we saw sales growth in the company’s profit loss statement but actually, the company doesn’t receive a penny for its sales. So in the operating cash flow statement, we find no revenue increase. Negative OCF indicates that the company is struggling to generate cash from its core operations.

5. Operating Cash Flow Ratio.

It measures the company’s capability to meet its current liabilities with the help of cash generated through its main operations. You can calculate it by dividing its total OCF by its current liabilities. It is also known as the “operating cash flow to current liabilities ratio”.

OCF ratio defines the liquidity status of a company in the short term. The OCF ratio of a company should be more than ‘1’ which means the company is generating more cash from its core operation than what it needs to pay off its liabilities. If the OCF ratio is less than 1 then it means the company has not generated sufficient cash to meet its liabilities and needs more money.

Further, keep in mind that a low OCF ratio does not always mean poor financial standing. In fact, it may indicate a fruitful investment opportunity.

You can derive the OCF ratio from the given below formula:

OCF Ratio = Operating Cash Flow / Current Liabilities.

6. Net Income vs Operating Cash Flow.

Net Income | Operating Cash Flow |

It is the profit earned within a period. | It is the net cash generated through the core operations of a company.

|

Net income is the starting matric required for computing a company’s operating cash flow.

| It represent as a measurement of a company’s daily cash inflow and outflow of its operations. |

It define company’s profitability and valuation of bonds and stock pricing.

| It define as a metric of a company’s capability to pay off its debt in the short-term.

|

In case of net income, there are chances to manipulate the figures.

| OCF gives a more transparent insight to the potential investors of a company’s finances. |

A company with a negative net income can still have positive OCF.

| High operating cash flow indicates the company have more cash to run and expand its business. |

Net income formula = Total revenue – Total expenses | Operating cash flow = Net income + Non-cash expenditure [depreciation, amortization] (+/-) Changes in assets and liabilities [net working capital] |

7. Operating Cash Flow vs. Free Cash Flow (FCF).

Operating Cash Flow (OCF) | Free Cash Flow (FCF) |

Operating Cash flow or OCF is simply defined as the amount of cash generated by a company through its core operation within a specific time. | Free cash flow is the amount of cash a company has left over after accounting for capital expenditures.

|

Operating cash flow is computed from the beginning of the accounting period to the end of the period. | Free cash flow is computed after subtracting capital expenditures from the operating cash flow. |

It measures the cash generated from the core business operations. | It measures the amount of cash available to shareholders, creditors and other stakeholders.

|

OCF includes cash from operating activities and excludes investments and financing activities

| FCF includes cash from both operating activities and investments activities but excludes financing activities. |

Operating cash flow does not consider dividends paid out to shareholders. | Free Cash Flow does take into account dividends paid out to shareholders. |

Operating cash flow is used to measure the operating performance of a company. | Free cash flow is used to measure the overall financial health of a company. |

8. How to Find Operating Cash Flow.

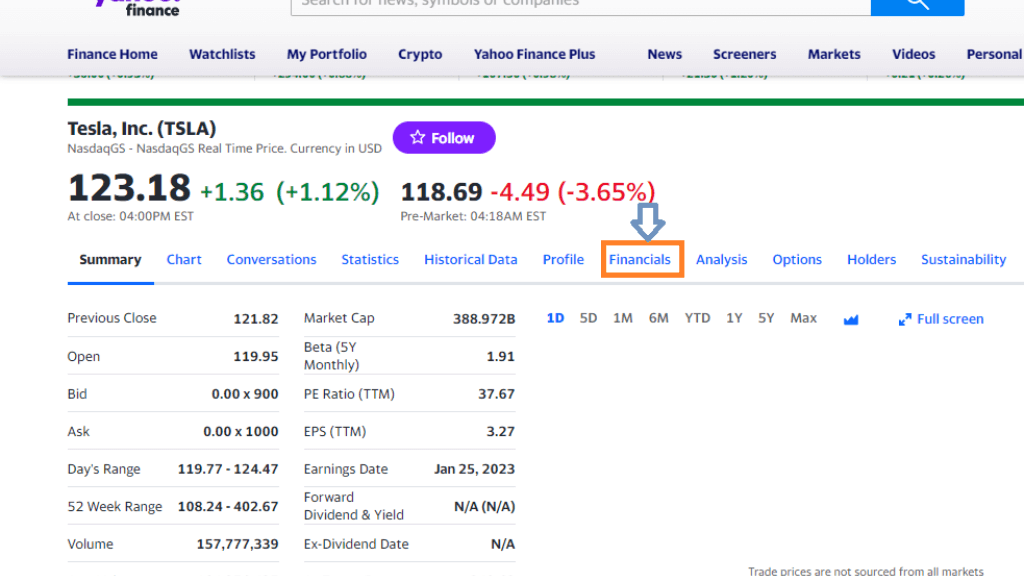

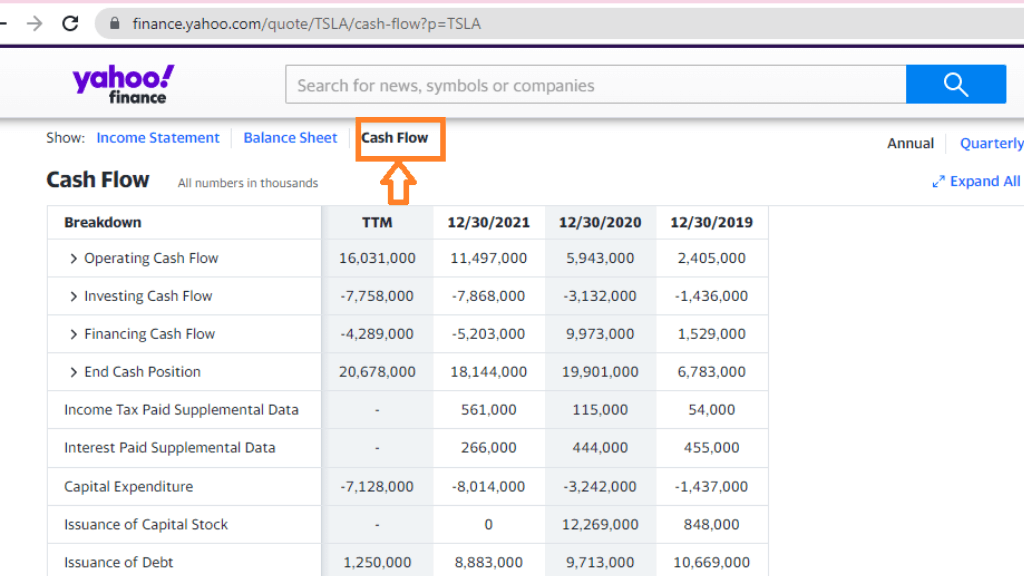

In this article, we have already discussed the importance of OCF to determine a business’s financial health and also describe two methods to calculate the OCF. But you don’t have to do manual efforts to calculate OCF. Many financial websites like yahoo finance provide all the financial metrics of a listed company. Here we take examples to find the OCF of Tesla company step by step.

- Open the Yahoo finance site in the browser and put the company name in the search bar whose OCF you want to know.

- Then click on the ‘Finacial Tab’.

- After that click on the ‘cash flow tab’ and you will find all desired information regarding cash flow metrics including OCF.

9. Conclusion.

In this article, we have discussed that operating cash flow is an important financial metric that gives a real picture of a company’s financial health. you can calculate OCF with two methods i.e. Direct method and the Indirect method. You don’t need to calculate manually OCF as many online platforms like yahoo finance are available where you can find all financials-related metrics of a company if listed in the stock market. We hope our article helps you to resolve your all queries above OCF. Please leave a comment if you like our article.

Read More: Taking Control of Your Finances With Budgeting Basics

10. FAQs

-

What is Cash Flow?

Cash flow means the amount of cash inflow and outflow in a business. In simple words, it means the amount of cash generated and consumed for a specific period. Potential investors do their analysis to find existing and possible sources of cash flow. Positive cash flow refers to sufficient liquidity available to a company to run and expand its operation whereas negative cash flow means a company doesn’t have sufficient liquidity to meet its liabilities.

-

What are The 3 Types of Cash Flows?

Depending upon the sources of cash flow, it can be divided into three types:

- Cash flow from operations.

- Cash flow from Investments.

- Cash flow from financing activities.

-

What are The 2 Methods of Operating Cash Flow?

Operating Cash flow or OCF is simply defined as the amount of cash generated by a company through its core operation within a specific time. It helps to analyze the actual financial condition of a company. It indicates whether the company is capable to generate sufficient cash to maintain, run and expand its existing operations. There are two methods to calculate OCF:

(1) Direct Method :

Operating Cash Flow (OCF)= Total Cash Revenues – Operating Expenses paid in cash

(2) Indirect Method :

Operating cash flow = Net income + Non-cash expenditure [depreciation, amortization] (+/-) Changes in assets and liabilities [net working capital]

-

Is Operating Cash Flow The Same as EBIT?

EBIT is used as an alternative to Net income but EBIT represents the net income of a company without including the cost of interest on debt and tax expenses. whereas OCF is the amount of cash generated by a company through its only core operation within a specific time. Fundamentally EBIT and operating cash flow are not always the same because a company may have other income like interest income that can inflate EBIT but not OCF.

-

Is Operating Cash Flow the same as income?

No there is a lot of difference between OCF and Net Income. Net income defines the total profit earned by a company in a specific period of time whereas OCF is actual cash generated by a company through only its core operation.

-

What If Operating Cash Flow Is More Than Net Profit?

In an ideal condition if operating cash flow is more than net profits it means the company is available to realize all its sales in a financial year and also receive payment in advance and the company has more cash to expand its operations. But an investor has to find out the real reasons for the increase in OCF than net profit.

-

Why Use EBITDA Instead of Free Cash Flow?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It is a measure of the profitability of an organization. whereas Free Cash flow means actual cash remains at the hand of an organization after paying off all liabilities. Both financial metrics have their own pros and cons. EBITDA is more useful when comparing the profitability of two companies. Free cash flow is more use full to analyze the performance of a company on its own merits.

-

How Do You Calculate Free Cash Flow from EBITDA?

If we have EBITDA then we can drive two Free cash flow metrics i.e. Free cash flow to Equity and free cash flow to the firm.

Free Cash Flow to equity = EBITDA -depreciation & amortization- interests- taxes – capital expenditures -net debs+ Change in working capitals + depreciation & amortization

Free Cash flow to firm = EBITDA -depreciation & amortization- interests- taxes – capital expenditures + Change in working capitals + depreciation & amortization+ interest x (1- Tax rate)

-

Is EBITDA the Same as Operating Cash Flow?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation and it is an important financial metric to measure the profitability of a company. The operating cash flow metric track the cash generated from the core operation of the business excluding cash flow from investing or other financial activities. EBITDA is much the same but it ignores interest or taxes factors but both are included in OCF.

-

What if Operating Cash Flow is Negative?

If you found OCF negative for a particular company then it means that the company is struggling to generate sufficient money from its core operations and to make up the difference the company needs more money from financing and investments which could be a sign of bad financial health.

Wow! Your blog post blew me away! Your ability to dissect complex topics and present them in a relatable, no-nonsense way is simply genius.

The article on your blog is knowledgeable and engaging, offering valuable information in a clear and clear manner. The site’s appealing layout and easy-to-use interface enhance the overall reading experience. Continue the great work!

Hey Blog Owner. I couldn’t stop nodding my head while reading your blog post. The way you capture the essence of the subject matter and express it with such cleverness and clarity is absolutely astonishing.

I just wanted to share my admiration for the visually appealing design of your blog. It’s invigorating to come across a website that combines aesthetics with informative articles. You’ve truly created a great balance!