It’s no secret that managing personal finances can sometimes be challenging. With the rise of digital payment solutions, such as Afterpay, consumers have gained a convenient way to split their purchases into manageable installments. However, a common concern that arises is what happens if you fail to make payments? Can you go to jail for not paying Afterpay? In this article, we will delve into the world of Afterpay and explore the potential consequences of neglecting your payment obligations. Let’s unravel this question and shed light on the truth behind it.

1. Introduction: Understanding Afterpay.

Before we delve into the consequences of not paying Afterpay, let’s first understand what Afterpay is and how it operates. Afterpay is a popular buy-now-pay-later (BNPL) platform launched in 2015 in Australia and in 2018 in the U.S.

according to a December 2020 Afterpay press release the company sold $2 billion worth of products nationwide in November 2020 & Over 13 million people in the U.S. have used Afterpay which allows consumers to make purchases and pay for them in installments over time. It offers a convenient alternative to traditional credit cards, providing shoppers with the flexibility to split their payments without incurring interest fees.

2. What is Afterpay?

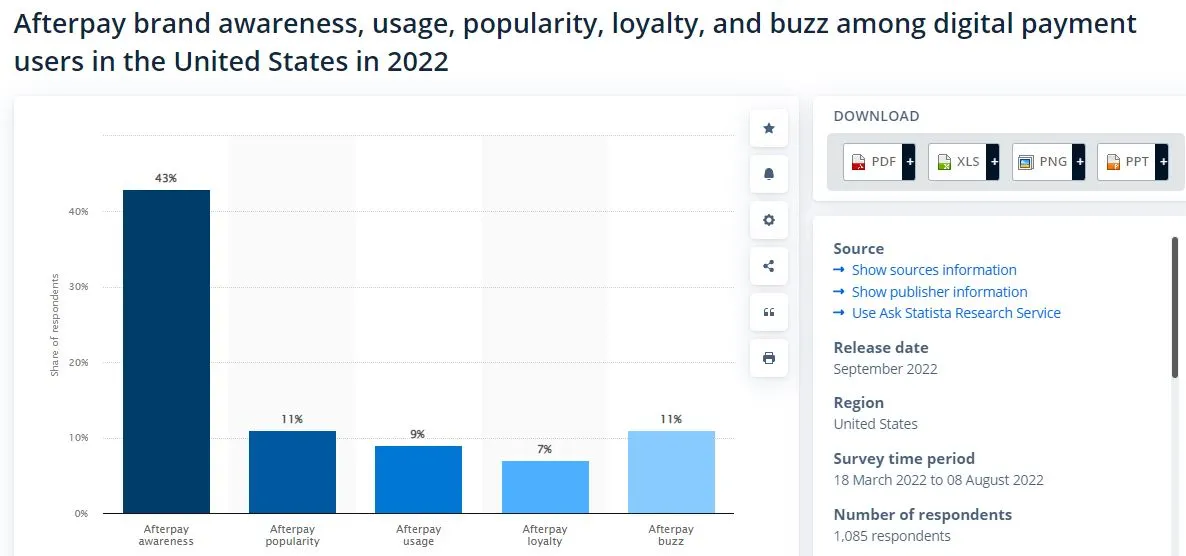

Afterpay functions as an intermediary between the consumer and the retailer. When making a purchase, you can choose Afterpay as your payment method. Instead of paying the full amount upfront, you pay a fraction of it at the time of purchase, and the remaining balance is divided into equal installments. These installments are automatically deducted from your linked debit or credit card every two weeks. Afterpay is becoming famous in the U.S. as per statists report brand awareness of Afterpay is at 43% in the United States.

3. How Does Afterpay Work?

To utilize Afterpay, you need to create an account and provide your payment details. Afterpay conducts a quick credit check during the sign-up process, but this check does not impact your credit score. Once approved, you can start shopping using Afterpay at participating retailers. The amount you can spend with Afterpay depends on your personal credit limit, which is determined by various factors.

4. The Consequences of Not Paying Afterpay.

4.1 Legal Actions and Consequences

Now, let’s address the pressing question: Can you go to jail for not paying Afterpay? The short answer is no. Failure to make Afterpay payments does not typically result in criminal charges or imprisonment. Afterpay is a civil debt, and the company does not have the authority to send you to jail for non-payment. However, this doesn’t mean you can completely ignore your Afterpay obligations without facing any consequences.

4.2 Impact on Credit Score.

While Afterpay cannot land you in jail, neglecting your payments can have other adverse effects. One significant consequence is the impact on your credit score. Afterpay reports missed or late payments to credit bureaus, which can result in a lower credit score. A lower credit score can make it difficult to obtain credit in the future, affecting your ability to secure loans, mortgages, or even rent an apartment.

4.3 Debt Collection Efforts.

When you fail to fulfill your Afterpay obligations, the company will undertake efforts to collect the outstanding debt. This includes contacting you to remind you of the missed payments and the outstanding balance. Afterpay may utilize internal collection departments or engage with third-party debt collection agencies to recover the owed funds. These agencies may employ various strategies to pursue repayment, such as phone calls, letters, or legal notifications.

5. The Importance of Fulfilling Afterpay Obligations.

Understanding the potential consequences of not paying Afterpay highlights the importance of honoring your financial commitments. Here are some reasons why fulfilling your Afterpay obligations is crucial.

5.1 Honoring Commitments.

When you make a purchase with Afterpay, you enter into a contractual agreement. Honoring this agreement builds trust between you and the company, fostering a positive consumer-business relationship. By fulfilling your Afterpay obligations, you demonstrate financial responsibility and integrity.

5.2 Building Trust and Creditworthiness.

Consistently meeting your Afterpay payments not only builds trust with Afterpay but also helps enhance your creditworthiness. Responsible financial behavior, such as making timely payments, positively influences your credit history. A robust credit history can open doors to future financial opportunities, offering you access to credit at favorable terms.

6. Seeking Assistance for Repayment Challenges.

Sometimes, unforeseen circumstances may arise that make it challenging to meet your Afterpay obligations. In such situations, it’s important to communicate with Afterpay and explore potential solutions.

6.1 Communication with Afterpay.

If you find yourself facing financial difficulties, reach out to Afterpay as soon as possible. They may be willing to work with you to create a repayment plan that suits your current circumstances. Open communication can help prevent the escalation of debt collection efforts and foster a collaborative approach to resolving repayment challenges.

6.2 Exploring Repayment Options.

Afterpay understands that life can be unpredictable. They may provide options to reschedule payments, waive late fees, or offer other flexible solutions to assist you in meeting your obligations. Exploring these repayment options can help alleviate immediate financial stress while maintaining a positive relationship with Afterpay.

7. Tips for Managing Afterpay Responsibly.

To ensure a smooth Afterpay experience and avoid any repayment difficulties, it’s essential to manage your Afterpay account responsibly. Here are some tips to help you stay on top of your payments.

7.1 Budgeting and Planning.

Before making a purchase with Afterpay, assess your budget and determine if the installments fit within your financial capabilities. Planning ahead and understanding the impact of Afterpay payments on your overall budget can prevent future repayment challenges.

👉 Read More: Taking Control of Your Finances With Budgeting Basics 🔥

7.2 Prioritizing Payments.

Make Afterpay payments a priority. Allocate funds in your budget specifically for your Afterpay obligations. By treating them as essential payments, you reduce the risk of missing deadlines and incurring late fees.

7.3 Monitoring Your Spending.

Regularly monitor your Afterpay transactions to keep track of your outstanding balances. Stay aware of upcoming payment due dates and ensure you have sufficient funds in your account to cover them. This proactive approach can prevent missed payments and minimize the chances of facing debt collection efforts.

7.4 Set Reminders.

Don’t rely on your memory to make your payments on time. Set up reminders on your phone or calendar to ensure you don’t miss a payment deadline.

7.5 Be Proactive.

If you do fall behind on your payments, don’t wait for Afterpay to take action. Reach out to them to discuss your options for getting back on track.

8. Conclusion: Honoring Your Afterpay Commitments.

Can you go to jail for not paying Afterpay is a common question but you cannot go to jail for not paying Afterpay while neglecting your payment obligations can have serious consequences. Failure to honor your Afterpay commitments can negatively impact your credit score and lead to debt collection efforts. By prioritizing responsible financial behavior and fulfilling your obligations, you not only maintain a positive relationship with Afterpay but also contribute to your own financial well-being.

9. FAQs

Q1: Can I go to jail for not paying Afterpay?

No, Afterpay is a civil debt, and not paying it typically does not result in criminal charges or imprisonment.

Q2: What legal actions can Afterpay take?

Afterpay can take legal action to recover the outstanding debt, such as engaging with debt collection agencies or pursuing a civil lawsuit.

Q3: Will not paying Afterpay affect my credit score?

Yes, missed or late Afterpay payments can be reported to credit bureaus, potentially resulting in a lower credit score.

Q4: How can I resolve repayment challenges with Afterpay?

Contact Afterpay as soon as possible to communicate your financial difficulties. They may offer flexible repayment options or assistance based on your circumstances.

Q5: What tips can help me manage Afterpay responsibly?

Budget and plan your Afterpay purchases, prioritize payments and monitor your spending to ensure you fulfill your obligations consistently.

Q6: Is There a Minimum Purchase Size When Using Afterpay?

No, Afterpay does not have a minimum purchase amount, but some stores might. You will need to check with the store to see if there is a minimum you must spend

Q7:Is There a Maximum Purchase Size When Using Afterpay?

Yes. How you use your account determines the maximum amount you can spend with Afterpay. Afterpay doesn’t specify what this maximum will be, as it varies from customer to customer credit history with it.

Q8: Does Afterpay Charge Fees?

Yes, and this is an important point. If you make your payments on time, Afterpay is free to use—you’re just paying for the item you bought.

However, if you pay late, you’ll owe a late fee worth $8 or potentially 25% of the order value. In addition, Afterpay won’t allow you to make any other purchases through its service until you make your past-due payment.

1 thought on “Can You Go to Jail for Not Paying Afterpay?”