‘Every person who graduates from school is financially illiterate’ This is a famous quote by Robert Kiyosaki. Financial knowledge is very important these times because of the easy availability of a variety of complex financial products to us. Financial ignorance may cost you so much as those who fail to understand the concept of interest & compounding, spend more on transaction fees, trap in bigger debts, and have higher interest rates on loans. So here we are going to discuss the top 12 financial literacy books which help you to understand the concept of wealth and will make you financially literate.

(Image Source: iStock/ illustration: wisenewsblog.com)

(Image Source: iStock/ illustration: wisenewsblog.com)

What is Financial Literacy and Facts and Stats?

No matter how much you earn, you will become a millionaire or billionaire only if you will understand the concept of money/wealth and become financially literate. This has been proven by many like Warren Buffett, and Robert Kiyosaki who became millionaires from ash without having ancestral wealth.

Financial literacy is the possession of skills that allows people to make smart decisions with their money. In simple words, Financial literacy is the ability and skills that allow people to make smart decisions with their money. It involves earning, budgeting, spending, borrowing, saving, and investing money.

Why Finance Knowledge is Important?

The study of the World Institute for Development Economics Research reports that the richest 1% of adults alone owned 40% of global assets in the year 2000 and that the richest 10% of adults owns 85% of the world’s total wealth.

Another Shocking fact is that 84% of the Stock market wealth in the U.S. is owned by only 10% of Americans as revealed by the National Bureau of Economic Research (NBER).

👉 Read More: Top18 Mind-Blowing Stock Market Facts 🔥

After knowing these facts one question may strike your mind, why a bunch of people owns more than 80% of the world’s wealth. You have seen many people around you who are earning very well but not financially stable but on the other hand, some people are financially stable with less earnings.

So the main difference between Rich and POOR is that the rich are more financially literate which allows them to make smart decisions with their money.

Financial Literacy Stats You Must Know.

As per the report of The S&P Global FinLit Survey On average, 52 percent of adults are financially literate in European Union.

On average, 55 percent of adults are Financially literate in major advanced economies like Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States.

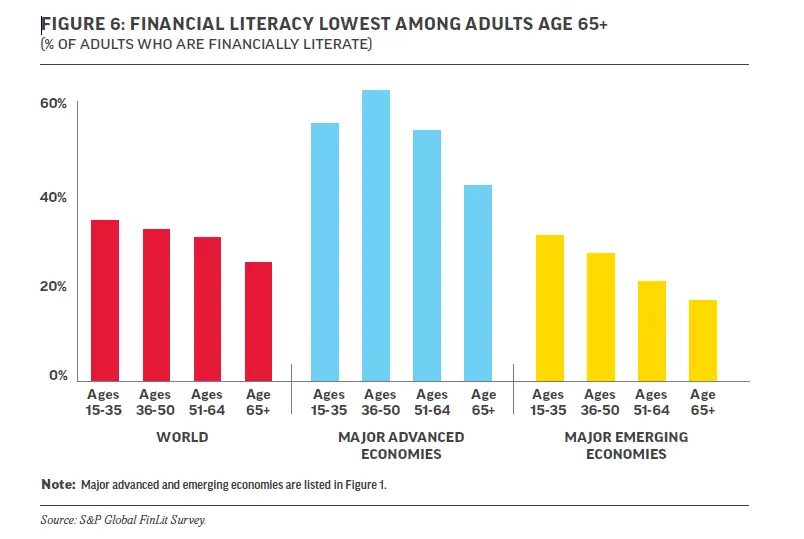

(Image Source: The S&P Global FinLit Survey)

(Image Source: The S&P Global FinLit Survey)

The literacy rate of adults in the major emerging economies of BRICS (Brazil, the Russian Federation, India, China, and South Africa) is only 28% on average.

Financial rates vary from gender to age group Worldwide, 35 percent of men are financially literate, compared with 30 percent of women.

Whereas on average, 56 percent of young adults aged 35 or younger are financially literate, compared with 63 percent of those aged 36 to 50. Financial literacy rates are lower for adults older than 50, and rates are lowest among those older than 65.

Why should You Read Financial Literacy Books?

We have already discussed various financial stats and we now know that on average more than 60 % of people in this world are financially illiterate so without an understanding of basic financial concepts, people will not be able to make wise decisions related to their financial management and always remain trapped in loans and credit irrespective to earnings and will never accumulate wealth.

Financially literate people can make informed financial choices regarding saving, investing, and borrowing. It is wise to learn secrets of financial knowledge from established well know financial authors and teachers who have proved themselves.

👉 Read More: The Secrets of the Millionaire Mind 🔥

Learnings from their Financial Literacy books will change your entire life & future and surly make you financially independent.

List of Top 12 Financial Literacy Books:

“Financial freedom is available to those who learn about it and work for it.” ― Robert Kiyosaki

Here we are going to provide you a list of 12 top-handpicked financial literacy books which will transform your thinking about wealth, and money and help you achieve financial freedom early.

👉 Read More: Top 12 steps to achieve financial freedom. 🔥

(1) “Think and Grow Rich” by Napoleon Hill.

This book was first published in 1937 and is one of the must-read financial literacy books. The global Rating of this book is 4.7 out of 5 on Amazon and people are still learning from it. This book is based on the research done by the author on more than forty millionaires to find out what makes them millionaires. This book helps you to train your brain toward becoming a millionaire.

The Main Key Takeaway:

- The starting point of all achievement is desire.

- To become a millionaire, you better learn from a millionaire.

- You are the master of your destiny.

(2) “Rich Dad Poor Dad” by Robert Kiyosaki.

This Financial literacy book is also one of the best sellers and came out in 1997 and focuses on the importance of financial literacy from an early age. This Book is also one of the must-read financial literacy books which is about Robert Kiyosaki and his two dads—his real father (Poor Dad) and the father of his best friend (Rich Dad)—and how both men shaped his thoughts about money and investing. Throughout the book, the author explains how a person can increase their wealth by investing in appreciating assets and by being smart with money.

The Main Key Takeaway:

- The poor and the middle-class work for money. The rich have money to work for them.

- It’s not how much money you make that matters. It’s how much money you keep.

- Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.

(3)”The Psychology of Money” by Morgan Housel.

In this book, author that is Morgan Housel explains how to have a better relationship with money and to make smarter financial decisions and our psychology can work for and against us. It is all about the strange ways people think about wealth, greed, and happiness.

The Main Key Takeaway:

- Everyone looks at money through the lens of their past experiences.

- Rich people do crazy things.

- Spending money to show people how much money you have is the fastest way to have less money.

(4) “Stop Acting Rich and Start Living Like a Real Millionaire” by Thomas J Stanley.

Stop Acting Rich book teaches how to live a rich, happy life by accumulating more wealth. So you can achieve that type of financial freedom which will deliver true happiness and financial independence.

The Main Key Takeaway:

- Learn the difference between being rich and acting rich.

- Wealthy people invest their money to meet their long-term goals.

- A non-millionaire tries to copy the ultra-wealthy and ends up with financial disasters.

(5) “The Intelligent Investor” by Benjamin Graham.

This book is a masterpiece for value investing and is treated as a bible by investors. Serious physicists read Sir Isaac Newton’s theories about gravity and motion whereas serious investors read Benjamin Graham’s Books teachings about finance and investment. Warren Buffett also acclaimed himself as his student.

The Main Key Takeaway:

- Never trust Mr. Market, he can be very irrational in the short and medium term.

- Focus on the company’s value and not trust the media hype.

- There are 3 principles to intelligent investing: analyze for the long term, protect yourself from losses, and don’t go for crazy profits.

(6) Investonomy by Pranjal Kamra.

Investonomy is written by Pranjal Kamra young author and value investor from India. This is a new book on the list of our must-read financial literacy books. In his book, he explains modern value investing principles but also unveils certain secrets of the stock market. He has busted popular myths and misconceptions as well. The Main USP of this book is the explanation of stock market concepts in such a simple way so that novice investors can easily understand.

- You just invest your money and forget about it. It is the best way to let your money grow in the stock market, as businesses take time to grow.

- Speculators bring fluctuations in the pricing of stocks. The volatility gives investors a fair chance to buy shares at low prices.

- Do you treat the stock investment as a monster or do you treat it like a friend? Whatever your strategy is, the stock market reciprocates the same.

(7)”Why Didn’t They Teach Me This in School” by Cary Siegel.

The author wrote this book to share his learning of personal finance first with his five children and then with others. This is one of the best sellers in its category and covers budgeting, spending, credit cards, investing, mortgages, insurance, and much more in plain English. This book shares wisdom about finance that you probably didn’t learn in school. If you want to gift something valuable to your children then this book is the best option.

The Main Key Takeaway:

- Spend Just One Hour Each Week Learning about Personal Finance.

- Pay off the highest interest rate debt first.

- Buy Less House than You Can Afford.

(8) “I Will Teach You to Be Rich” by Ramit Sethi.

This personal finance book reveals how to maintain and grow your money systems that lead to a rich life. In this book, the author explains various concepts about how to beat banks, regulate your credit cards, invest, and spend wisely.

The Main Key Takeaway:

- There’s a limit to how much you can cut, but no limit to how much you can earn.

- You don’t need to be an expert to get rich but you do need to get started early.

- In relationships and work, we want to be better than average. In investing, the average is great.

(9) “The Millionaire Next Door” By Thomas Stanley.

This book explains how simple spending and saving habits lead to more cash in your bank than most people earn in their life. This book is written after extensive study on millionaires in the USA and reveals the reality of how people accumulate extraordinary wealth.

The Main Key Takeaway:

- Save responsibly from the moment you first start earning more than you need to live.

- Efficiently allocate your time, energy, and money to build wealth.

- Don’t fall for economic outpatient care to see your bank account reach seven figures.

(10) “The Richest Engineer” by Abhishek Kumar.

In this book, the author reveals the timeless wisdom of wealth creation & accumulation and shows how anybody – no matter where they are in life at this time – can become a millionaire.

In this book, the author asks a fundamental question: “Have you ever wondered why some people get rich easily while others struggle financially all their lives?” and provides an answer to this question with the help of a very interesting story.

The Main Key Takeaway:

- We have been wrongly taught about money throughout our life.

- Learn ways to increase your income and decrease expenses.

- Anyone can become rich.

(11) “From The Rat Race to Financial Freedom” by Manoj Arora.

Manoj Arora has worked for the best of Fortune 500 organizations across the globe. An Engineering gold medallist and an IT executive-turned-author. In this book, he takes his own life as an example to illustrate how everyone gets lost in the mad race to earn a living, acquire wealth, and ensure financial security for themselves and their family. The book teaches the true meaning of “Financial independence” in the simplest way possible based on the Indian financial market.

The Main Key Takeaway:

- Gold should be an important part of a diversified investment portfolio because its price increases in response to events that cause the value of paper investments.

- Financial freedom is not defined by your net worth or your social status.

- Term Insurance is the best “value for money” as far as financial security is concerned.

(12) “The Simplest Path to Wealth” by J.L. Collins.

This book teaches personal finance in a very effective way so anyone can understand and increase his financial knowledge. In this book, the author teaches a three-step template for straightforwardly achieving financial freedom, passed from a wealthy man to his teenage daughter through a series of letters.

The Main Key Takeaway:

- Always spend less money than you earn.

- Get out of debt as fast as you can — and stay there.

- The market is the single best-performing investment class over time, bar none.

On a Final Note:

“Some books leave us free and some books make us free” This quote from ” Ralph Waldo Emerson” seems small at first sight but has deep meaning hidden inside it. The financial literacy rate is around 50% in developed countries and it is the main reason why 10% of people own 85% of the world’s total wealth. You should read financial literacy books because personal finance is not taught in formal education. You can’t imagine how these handpicked books on financial literacy will open your eyes to financial wisdom and lead you to make smart decisions with your money to achieve financial freedom.