Investing is the only way to grow wealth and achieve financial goals. But is necessary to put the track on multiple diversified investments/stocks and this is the main headache related to investments. Here online Finance portfolio platforms come to play an important role, they make it easier than ever to manage your portfolio. One of the most well-known and often-used platforms for tracking investments is Google Finance. As with any service, there are Google Finance alternatives that might suit your needs better. In this article, we will explore some of the best alternatives to Google Finance portfolio.

What is Google Finance Portfolio Manager?

Google Finance was Launched in 2006 and became a primary platform for individuals to track and monitor the markets and their own Investment portfolios. It works well for novice investors. It provided a variety of information and news about the financial parameters of the listed companies and real-time stock charts. (Image Source: googlefinance.com)

(Image Source: googlefinance.com)

It provides a facility to create a watch list of your stocks, quick access to see historical prices, current and previous closing prices as well as 52-week highs and lows. It provides P/E Raito, Market cap, and dividend yield at a glance.

Why Have Investors Started Looking for Alternatives to Google Finance Portfolio Manager?

For years, Google Finance was one of the best portfolio trackers due is its simplicity. It was one of the top platforms for investment information and tracking stocks. But in 2018 Google made some significant changes to make it more simple that reduced the amount of core information provided related to stock investments.

One big change was reducing the number of publicly traded companies it tracked on a regular basis. Professional investors were annoyed with these changes because limitation of in-depth information related to their investment portfolio to track and analyze their investment to make wise decisions.

👉ReadMore: Taking Control of Your Finances With Budgeting Basics 🔥

Top 10 Alternatives to Google Finance Portfolio.

In the present scenario, Google Finance portfolio service is good for those who are new and still in the initial phase of Stock market learning due to its simple user-friendly interface. But Professional investors need in-depth information about all core financial parameters which helps them to research, track, and analyze their portfolio to make wise investment decisions. Below, compare some of the best options out there choose the right one for yourself.

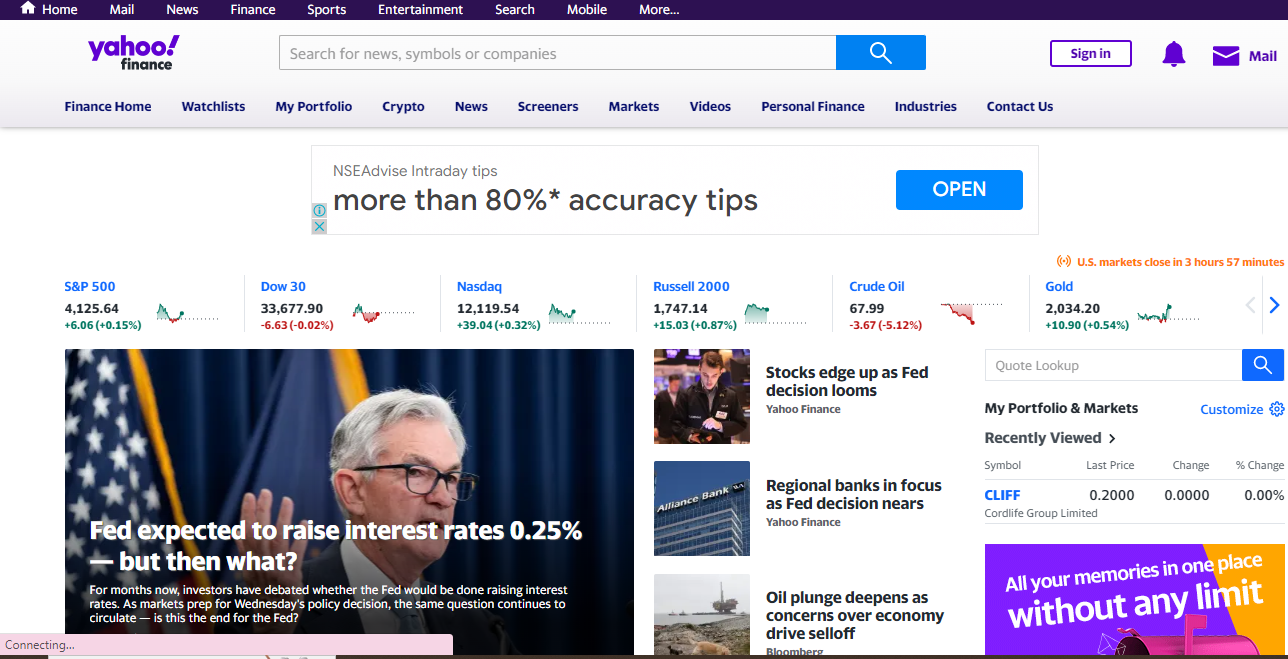

1. Yahoo Finance:

Yahoo Finance is one of the best alternative to Google Finance portfolio manager. It was launched back in 1994 and is available for mobile devices, tablets, and web versions. It provides real-time stock quotes and market updates, customizable watchlists, and a comprehensive news section.

Additionally, Yahoo Finance allows you to track your portfolio’s performance and compare it to various indices. Yahoo Finance helps you to stay updated on your investments and make informed decisions.

Compared to Google Finance portfolio, Yahoo Finance offers more features and a more user-friendly interface. Google Finance is simple and easy to use but it lacks the depth of information that Yahoo Finance provides. Overall, Yahoo Finance is a great alternative for those looking for a more comprehensive investing platform.

Strengths:

- Its homepage is very well organized and user-friendly which helps user to navigate easily.

- It provides Comprehensive Financial Data including stock prices, historical data, financial statements, and news articles, all in one place.

- Yahoo Finance has a large community of users who share their insights and opinions on the platform.

Weaknesses:

- Much of the editorial content is made up of sponsored posts. It can be hard to determine the difference between legitimate content and ad posts.

- Yahoo Finance’s customer support is limited, with users reporting slow response times and difficulty in getting issues resolved.

- In pastYahoo Finance has experienced several security breaches which further raised concerns about the security of the personal and financial data of users.

2. Personal Capital (Empower.com):

Personal Capital now known as empower.com is a financial management platform that offers a wide range of services, including investment management, retirement planning, and budgeting tools. It comes in two versions i.e. free tools, and wealth management.

Personal Capital’s investment management service includes a robust portfolio tracking feature that allows you to monitor your investments and track your performance.

Personal Capital offers a wide range of tools and services that Google Finance portfolio does not provide. However, the platform can be overwhelming for those who are new to investing. Personal Capital charges a management fee for its investment management service, which may not be attractive to all investors.

Personal Capital provides direct investment management through its Wealth Management service in the paid version and is not to be confused with a robo-advisor, this is more of a technology-assisted investment

Strengths:

- The free version offers some pretty good tools for budgeting, spending, retirement, and calculators.

- it provides a variety of financial tools and services as savings accounts, investment accounts, and credit monitoring services.

- Personal finance platforms have the ability to automate financial tasks, such as bill payments and savings contributions, which helps users to save time.

- Unlike the competition, this platform isn’t crowded with third-party ads.

Weaknesses:

- This platform may not provide personal financial advisors, which can make it difficult for users to get personalized financial advice and guidance.

- Although its free tools are pretty good, the best service is offered under the premium Wealth Management version.

3. Morningstar:

Morningstar is a financial research and analysis company that provides a variety of services, including investment research, portfolio management, and retirement planning. It has over $220 billion in assets under management and provides a variety of services, including investment research, portfolio management, and retirement planning.

Morningstar’s portfolio tracking feature allows you to monitor your investments and compare them to various benchmarks.

Morningstar also offers a variety of premium services, including Dividend Investor, StockInvestor, Fund Investor, and ETF Investor, for investors looking for more specific information and guidance in depth.

Strengths:

- Morningstar has a strong reputation in the financial industry, which gives investors confidence in their recommendations and analysis.

- It offers a lot of educational resources, articles, videos, and webinars, to help investors improve their financial skills.

- Morningstar provides in-depth data and insights on various financial products, including historical performance, risk, and other key metrics.

- It provides user-friendly investment tools such as portfolio management and analysis, asset allocation, and retirement planning.

Weaknesses:

- Much of the most valuable tools and information require a paid subscription

- Morningstar’s premium services can be expensive, which may not be ideal for investors on a tight budget.

- Morningstar’s focus is primarily on stocks, mutual funds, and ETFs. They do not offer research on other investment options, such as real estate or commodities.

- Its rating system can be complex and difficult to understand for novice investors.

Compared to Google Finance portfolio, Morningstar offers more in-depth analysis and research tools. However, Morningstar’s platform can be complicated for those who are new to investing.

Additionally, Morningstar’s services are more focused on Professional investors who are looking for advanced research and analysis tools. Unfortunately, this platform offers more valuable content for paid members only.

4. SigFig:

SigFig is a robo-advisor that provides portfolio-tracking tools and also investment management services. SigFig’s portfolio tracking feature allows you to monitor your investments and track your performance.

It works specifically with accounts held at either Fidelity or Charles Schwab. It analyzes and manages your portfolio, providing balanced asset allocations, and minimizing fees.

Additionally, SigFig offers a variety of investment management services, including portfolio rebalancing and tax-loss harvesting. This platform charges an annual management fee of 0.25% of your asset under management and requires a minimum initial investment of $2,000.

SigFig is a great alternative to Google Finance portfolio for those who are looking for a more hands-off approach to investing. SigFig’s robo-advisor service can automate your investment, which can be helpful for saving the time of investors and they can put more focus on search and analysis.

Strengths:

- This platform has no ads as it’s not an information source.

- It Manages both taxable investment accounts and retirement accounts.

- SigFig charges low fees as compared to its competitor investment advisory services. For accounts with a minimum balance of $2,000, SigFig charges a flat fee of $10 per month.

- It offers diversified portfolio management. It automatically allocates clients’ investments into stocks, bonds, and ETFs, based on their risk appetite and goals.

Weaknesses:

- This has a limited number of investment options compared to other investment management platforms.

- SigFig offers no free tools to help you with self-directed investing.

- This does not provide investors with access to human advisors and this platform relies on robo-advisors.

- The platform does not provide in-depth research reports or analysis, which may be a drawback for investors who want to make informed investment decisions

5. E*TRADE:

E*TRADE is an online brokerage firm founded in 1982 that offers a variety of services, including investment management, portfolio tracking tools, robo-advisor services, and a range of investment options.

Compared to Google Finance portfolio, ETRADE offers more in-depth analysis and investment management services.

This platform can be good for new investors, but it is a great option for experienced investors due to its wide range of investment options and advanced tools.

Strengths:

- The E*TRADE platform has a user-friendly interface and a customizable dashboard that allows users to personalize their trading experience.

- This platform provides advanced trading tools for experienced traders.

- E*TRADE has a mobile app that is available for both iOS and Android devices.

- It provides a wide range of investment options like stocks, mutual funds, ETFs, Futures, and options and provides access to the IPOs.

Weaknesses:

- It charges high fees for some of its services. For example, it charges a $6.95 commission for online equity trades.

- It has limited access to mutual funds compared to some of its competitors and some ETFs on ETRADE come with high expense ratios.

- The platform charges a $10 inactivity fee if there is no trading activity or balance changes in the account for more than 12 months.

- Its customer service has been reported as poor and unresponsive by some users.

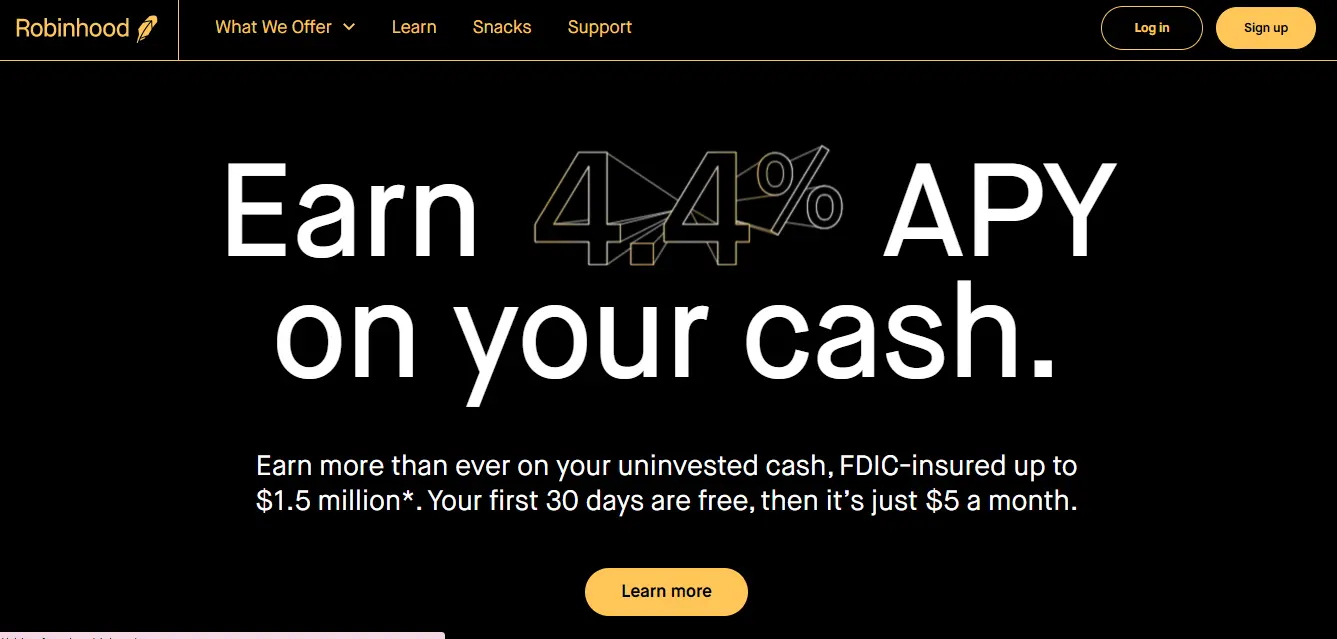

6. Robinhood:

Robinhood is a commission-free trading platform that was founded in 2013 and offers a variety of investment options, including stocks, options, and cryptocurrencies.

Robinhood’s portfolio tracking feature allows you to monitor your investments and track your performance. Additionally, Robinhood offers a variety of investment management services, including robo-advisor services.

Compared to Google Finance portfolio, Robinhood offers a wider range of investment options and is more geared towards active traders.

However, Robinhood’s platform is less comprehensive and lacks the research and analysis tools provided by other alternatives. Additionally, Robinhood has faced some controversy in the past, which may be a concern for some investors.

Strengths:

- The most significant strength of the Robinhood platform is its commission-free trading & users can buy and sell stocks, options, and cryptocurrencies without paying any commission fees.

- This platform has a clean user friendly and modern design, and the dashboard provides users with an overview of their investments and trading activity.

- Its main advantage is that it offers fractional shares, which allows users to invest in stocks and ETFs for as little as $1.

- the Robinhood platform also allows users to trade cryptocurrencies in addition to stocks and options.

Weaknesses:

- It offers a range of investment options but is still relatively limited compared to other brokerage firms as it does not offer mutual funds or bonds.

- Robinhood platform is that it does not offer retirement accounts such as IRAs or 401(k)s.

- It has reported several outages and technical issues, particularly during periods of high trading volume.

- Robinhood platform has faced criticism for its customer service as many of its users report long wait times and difficulty contacting customer support.

7. TD Ameritrade:

TD Ameritrade is an online brokerage firm that offers a variety of services, including investment management and portfolio tracking tools. TD Ameritrade’s portfolio tracking feature allows you to monitor your investments and track your performance.

Compared to Google Finance portfolio, TD Ameritrade offers more advanced research and analysis tools. TD Ameritrade’s platform is more comprehensive and user-friendly.

However, TD Ameritrade’s fees and commissions may be higher than other alternatives, which may be a concern for some investors.

Strengths:

- TD Ameritrade offers a wide range of extensive Investment Options. It offers more than 4,000 mutual funds, including no-transaction-fee (NTF) funds, and over 300 commission-free ETFs.

- It has a paper money feature that allows investors to practice trading without risking real money.

- TD Ameritrade provides excellent customer service.

- It provides various resources, including webinars, video tutorials, and articles, to help investors learn about investing and trading.

Weaknesses:

- TD Ameritrade’s commissions for trading stocks and ETFs are on the high side compared to some of its competitors, its standard commission rate for other ETFs and stocks is

- per trade.

- This platform charges a $0 inactivity fee, but only if the account has a balance of $0 or there are no trades placed in the previous 12 months but charges a $15 per quarter inactive fee for an account that has a balance of less than $2,000

- TD Ameritrade doesn’t offer fractional shares trading, which can be a disadvantage for investors who want to buy expensive stocks.

8. Fidelity:

Fidelity is an online brokerage firm that offers a variety of services, including investment management and portfolio tracking tools. Fidelity is one of the largest, oldest investment companies. Fidelity’s portfolio tracking feature allows you to monitor your investments and track your performance.

Fidelity offers a range of investment options and investment management services. A lot even have a 0% expense ratio. Besides Fidelity funds, it also offers over 10,000 funds from other companies.

Compared to Google Finance portfolio, Fidelity offers more in-depth analysis and research tools. Additionally, Fidelity’s platform is more user-friendly and comprehensive. However, Fidelity’s fees and commissions may be higher than other alternatives, which may be a concern for some investors.

Strengths:

- Fidelity’s online trading platform is user-friendly and It also offers a mobile app that allows investors to trade and manage their investments on the go.

- Fidelity offers commission-free trading for stocks, ETFs, and options and offers the lowest mutual fund fee.

- Fidelity is known for its excellent customer service, which is available 24/7 through phone, email, and live chat.

- Fidelity’s research tools are top-notch and can be very helpful to both beginner and experienced investors.

Weaknesses:

- One of the main drawbacks of Fidelity is that it has high account minimums a minimum of $2,500 to invest.

- Fidelity’s mutual funds have minimum investments that can be quite high, with some funds requiring minimum investments of $10,000.

- This platform also charges inactivity fees for accounts that have not made any trades in a certain period of time.

- Fidelity does not offer fractional shares, which means that investors must buy whole shares of stocks and ETFs.

9. Investing.com:

Investing.com was internationally based and was launched in 2007, just one year behind Google Finance. It was originally designed to be a FOREX platform but later it started dealing with other investments like stocks, bonds, futures, options, currencies, cryptocurrencies, and commodities.

It provides a Free wide range of tools and resources that are streaming quotes, technical data, extensive chart capabilities, and financial news and analysis to make wise decisions for their investments.

Strengths:

- Investing.com is free to use, which makes it attractive to common investors. The website generates revenue through advertising but Ads on the website are relatively limited, compared to the competition.

- Its well-organized design helps the user to find the information they need.

- This platform is also available in a mobile app.

- Investing.com has a large community that allows its users to connect and share their ideas and strategies with other investors.

Weaknesses:

- This platform contains a significant amount of sponsored content on the homepage.

- Investing.com has limited customization options & does not allow users to create custom indicators or backtest trading strategies.

- While Investing.com provides a wide range of financial data and analysis, the platform has limited research capabilities.

- it does not allow users to trade directly on the platform. Instead, users must link their brokerage account to the platform in order to make trades.

10. Finviz:

Finviz offers a user-friendly platform with powerful financial, and portfolio management tools. it’s good at research and analysis due to its powerful filter and screeners.

Finviz also offers a heat map feature that allows users to quickly visualize market trends and see how various stocks and sectors are performing.

Additionally, the platform provides a variety of other market data, including futures, options, forex, and cryptocurrency information.

Strengths:

- The biggest strength of FinViz is its power full filters and screeners.

- The website also offers real-time market data throughout the day and provides in-depth market data for various assets like stocks, futures, currencies, and cryptocurrencies.

- FinViz offers a range of advanced customizable charting tools that allow traders and investors to analyze market trends and patterns.

- It provides a variety of news and analysis resources, including market news, company news, and analyst recommendations.

Weaknesses:

- FinViz does not offer as many educational resources as some other financial websites.

- It does not offer a portfolio tracking feature and portfolio tools such as a screener, which can be a drawback for investors who want to monitor their investments in real-time.

Conclusion.

In today’s technology-driven investment world, there are several kinds of personal finance platforms and portfolio manager platforms available. Google Finance portfolio was one of the best portfolio trackers available but it loose its competition due to a lack of advanced financial tools. There are many alternatives to Google Finance portfolio, each with its own unique features and benefits. Review these financial platforms that we’ve discussed and you can choose one as per your financial need.

FAQs

- Are there any free alternatives to Google Finance portfolio?

Ans: Yes, there are several free alternatives available such as Yahoo Finance, Investing.com, and robinhood.com.

- Can I use multiple portfolio tracking platforms at once?

Ans: Yes, you can use multiple platforms to track your investments. However, it is important to ensure that the information on each platform is up-to-date and accurate.

- Which alternative to Google Finance portfolio is best for new investors?

Ans: For new investors, a platform with a user-friendly interface and a range of investment options, such as yahoo finance or Robinhood, maybe the best choice.

- Are there any alternatives that offer advanced research and analysis tools?

Ans: Yes, platforms such as TD Ameritrade and Fidelity offer more advanced research and analysis tools than Google Finance portfolio.

- What should I consider when choosing an alternative to Google Finance portfolio?

Ans: When choosing an alternative, it is important to consider factors such as fees and commissions, investment options, research and analysis tools, and user interface.

2 thoughts on “Top10 Alternatives for Google Finance Portfolio Manager 💣”