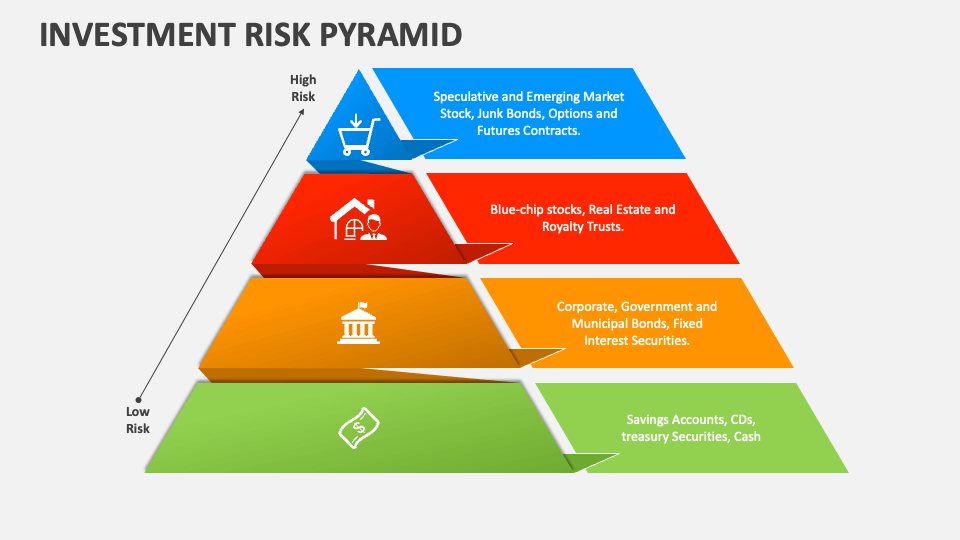

If you want to create a solid and diversified investment portfolio then you should understand the Investment Risk Pyramid approach. Don’t confuse it with other Ponzi money-making schemes like MLM Pyramid Schemes. The Investment risk pyramid is a well-proven investing strategy that graphically illustrates many investment possibilities and the levels of risk attached to each. While understanding the four levels of the Investment Risk Pyramid you will understand why stocks are viewed as riskier than bonds, and the pyramid investment strategy will all be covered in this article.

What is The Investment Risk Pyramid?

The Investment Risk Pyramid is a strategy also known as Pyramid Investment that helps to create a diversified portfolio. Investors can determine and understand the possible risks and returns of various investment opportunities.

Always remember in the world of investing risk and return are symbiotic. In general, the risk is larger when the possible reward is bigger. In contrast, investments with lesser risk often have lower returns.

The Four Levels of the Investment Pyramid:

1. Level 1: Low-Risk Investments:

Low-risk investments are located at the pyramid’s base. This level contained stable and low-volatility investment instruments like Savings accounts, certificates of deposit (CDs), and government bonds.

2. Level 2: Moderate-Risk Investments:

Moving up the pyramid, we find moderate-risk investments. These investments offer a suitable balance of risk and reward.

This category often includes established company stocks, corporate bonds, and real estate investment trusts (REITs). They are riskier than low-risk investments but have the potential to generate high returns.

3. Level 3: High-Risk Investments

The third level of the pyramid represents high-risk investments. These are investments with high volatility and high risk but have the potential to generate high returns

Examples include individual stocks of smaller companies, high-yield (junk) bonds, and speculative investments like cryptocurrencies.

4. Level 4: Speculative Investments

At the top of the pyramid, we have speculative investments. These are the riskiest and often the most unpredictable options.

Start-up investments, penny stocks, and highly leveraged financial instruments like options and futures fall into this category.

They can generate significant returns, but they also have the potential to generate huge losses.

Why Are Stocks Considered Riskier than Bonds?

Stocks are generally considered riskier than bonds due to several key factors:

Ownership vs. Debt:

When you buy stocks, you become a partial owner of the company. If the company experiences financial difficulties or goes bankrupt, stockholders may lose their entire investment.

On the other hand, bonds represent debt that the company owes to bondholders. Even if a company faces financial challenges, it typically must repay its bondholders before distributing assets to shareholders.

Volatility:

Stocks tend to be more volatile than bonds. Their prices can change a lot over short periods of time depending on things like business performance, the state of the economy, and the market mood. Bonds are generally more stable and less prone to extreme price swings.

Return Potential:

To compensate for the higher risk, stocks have the potential for greater long-term returns. Historically, over extended periods, the average return on stocks has exceeded that of bonds.

This does come with the warning that short-term stock movements can be rather significant.

What is The Pyramid Investment Method?

The pyramid investment approach, which involves spreading your portfolio across various risk categories, heavily relies on the Investment Risk Pyramid.

This strategy aims to balance risk and profit by combining low-risk, moderate-risk, and maybe high-risk investments. You can spread your risk and lessen the effects of a single investment’s bad performance by diversifying.

A portfolio that is properly diversified, for instance, might mix low-risk investments like government bonds with moderate-risk ones like blue-chip stocks and a smaller portion of high-risk ones like emerging market equities. Your financial objectives, level of risk tolerance, and time horizon all affect the precise allocation.

Historical Facts and Statistics:

To put the concepts of the Investment Risk Pyramid and the pyramid investment method into perspective, let’s take a look at some historical facts and statistics:

- Stock Market Performance: Over the long term, the U.S. stock market, represented by indices like the S&P 500, has delivered an average annual return of approximately 7% to 9%. However, this return comes with significant year-to-year variability.

- Bond Market: Investment-grade bonds, such as U.S. Treasury bonds, have historically provided more stable returns compared to stocks. According to the Morning Star long-term government bonds have returned between 5% and 6%. The returns of the bond market depend upon interest rates, inflation, and credit risk.

- Diversification: Studies have shown that a well-diversified portfolio that includes a mix of asset classes tends to exhibit lower volatility and a smoother investment journey. Diversification can help to reduce the impact of market downturns.

Conclusion:

The Investment Risk Pyramid helps investors understand the level of risk of various investment instruments to make wise investment decisions. You can use this framework to create a diversified portfolio according to your Financial Goals by evaluating and understanding your risk tolerance and time horizon. Keep in mind that high profit-generating financial instruments carry high risk. So in order to achieve your financial goals, it’s important to find the correct balance within your portfolio.

FAQs

Q 1: How can I determine my risk tolerance?

Determining your risk tolerance involves assessing your financial goals, time horizon, and comfort level with market fluctuations. You can also consult with a financial advisor for guidance.

Q 2: Are high-risk investments suitable for everyone?

No, high-risk investments are not suitable for everyone. They are suited for those who have wide experience in the market can withstand market volatility and have a long-term investment horizon.

Q 3: Can I use the Investment Risk Pyramid for long-term goals?

Yes, the Investment Risk Pyramid can be adapted for long-term goals. With the help of this strategy, you can adopt a structured approach to managing risk while working towards your financial objectives.

Q 4: What are some low-risk investment options?

Low-risk investment options include savings accounts, certificates of deposit (CDs), and treasury bonds. These offer capital preservation with minimal risk.

Q 5: How do I stay updated on market risks and trends?

It’s important for investors to keep a watch on market developments. This can be achieved by constantly reading financial news and financial Blogs. A wise investor always stays in touch with the market to watch the ups and downs of the market and align his investment strategy accordingly.