ESG Investing approach has gained significant popularity in recent years but still is a new concept for many newbies and individual investors. Those days are gone when investing is solely focused on returns and profits. This secret investing approach goes beyond just making profits and aims to generate returns that benefit investors as well as contribute to the betterment of society. In this article, we’ll uncover ESG Meaning, ESG Investing Trends, Its Metrics, and many more. So stay with us.

1. Understanding ESG Investing:

ESG investing approach has now become a mainstream investment approach. In the present financial world investors look for investment opportunities that will not only make returns but also contribute to environmental protection, social justice, and ethical management practices.

ESG investing is also known by other names such as Sustainable Investing, Impact Investing, Socially Responsible Investing, and Ethical Investing.

1.2. What is ESG Investing?

ESG stands for Environmental, Social, and Governance. These three factors are used by investors to evaluate a company or business along with its performance and profitability.

The Environmental factor helps the investor to measure the impact of a company on the environment.

The Social Factor is used to evaluate the relationship of a company with its employees and social communities and the Governance factor defines the leadership and ethical practice of a business.

Moreover, the definition of Success in investing has now broadened by ESG Investing. Investors acknowledge that financial returns can not be sufficient indicators alone to represent the true worth of a company.

Companies, those taking into account their environmental, social, and governance performance, perform well in the long term and deliver sustainable returns.

💡 “Investors generally believe that the money is only a true indicator of success. But the future will depend upon the non-financial metrics.”

1.3. What is The Origin of ESG Investing?

The Concept of ESG investing or ethical investing has been evolving for decades. Examples include stopping investments in slave labor, Investors made the decision to stop investments in the tobacco production business in the 1960s as socially responsible investing, and divestments from South Africa were first advocated to protest the country’s system of apartheid.

The Pax World Fund was established in 1971 by two United Methodist ministers who opposed the Vietnam War. It was the first publicly accessible mutual fund in the United States to consider social and environmental factors while making investment decisions.

These kinds of incidents showed customers, investors, and governments the impact and influence of corporations on their environment to shape the world.

ESG in the modern context was brought by a report titled Who Cares Wins of the United Nations in 2004. All corporate stakeholders are encouraged by this research to adopt ESG for the long term.

✍ Key Highlights :

- ESG investing approach is used to combine profit with societal betterment.

- ESG is also known as Sustainable, Impact, Socially Responsible, and Ethical Investing.

- Investors can assess a company’s environmental, social, and governance impact.

- Following the ESG investing approach investor can reduce risk, lowers costs, and improves portfolio performance.

- ESG strategies include Integration, Exclusionary, Inclusionary, and Impact Investing.

- Metrics of the ESG cover environmental, social, and governance indicators.

- Widely used reporting frameworks include GRI and ISO.

- Top-performing ESG stocks for 2023 include Nvidia, Microsoft, and Best Buy.

- ESG investing trends for 2023 focus on climate change, corporate governance, diversity, sustainability, regulation, ethical supply chains, and avoiding greenwashing.

2. What are The Benefits of Trending ESG Investing?

Making an investment decision considering the ESG factor will be a wise move. There are many benefits of ESG Investing and we are going to discuss them one by one.

2.1. Reduce Risk:

ESG encourages companies to run their business ethically and transparently. Companies that have good corporate structures have a better chance of being sustainable in the long run and thus have more ability to attract investors.

By using the ESG Approach Investors can avoid companies that have questionable practices or are irresponsible. A wise investor knows that ‘good management’ can run a ‘bad business‘ but a ‘bad management‘ can’t run a ‘good business’.One can reduce the risk of losing money by focusing on responsible investing.

2.2. Lower Investing Cost:

For many investors especially individual investors, fee is the major concern while investing.

It has been seen that companies with ESG inheritance have sustainable businesses and are more efficient and cost-effective over time because they don’t need to spend on massive advertising campaigns.

This helps companies to cut fees and other investing charges to attract more investors.

2.3. Better Portfolio Performance:

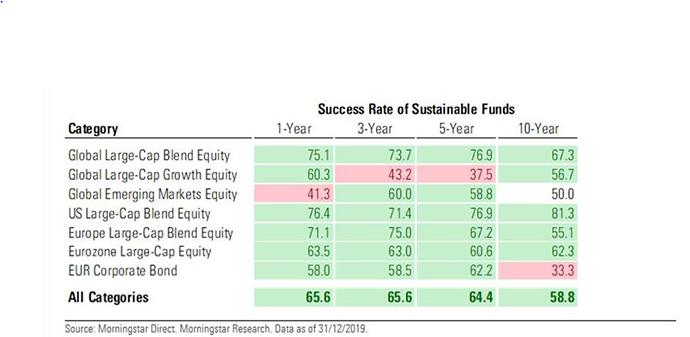

Several times ESG investments have outperformed non-ESG investments. As per the report of Morning Star, 58 % of the sustainable funds outperformed traditional funds globally over 10 years. Same as the Success rate of U.S. sustainable funds remained at 81.3% over 10 years.

McKinsey also claimed the correlation ship of ESG with higher equity returns as well as a reduction in downside risk.

Moreover a positive relationship between ESG and financial performance in 58% of corporations was found in the research by the NYI Stern Center for Sustainable Business and Rockefeller Asset Management.

All these findings prove that the business having ESG properties performing well amongst the traditional businesses over a long period.

2.4. Positive Impact on The Environment:

Trending ESG Investing can help to make our environment clean and reduce carbon emissions. Media and public pressure are forcing businesses to invest in green bonds which have a focus on funding those projects working the the field of reducing carbon emissions, improving air quality, and promoting sustainable resources and clean transportation.

Also, many renowned investors favor companies that support initiatives to reduce their carbon footprint by increasing energy efficiency and sourcing renewable energy.

2.5. Helps to Improve Work Culture:

ESG Investing encourages businesses to improve their work culture by Implementing policies that ensure a safe working environment, protect employee welfare, and promote a healthy work-life balance. These policies raise the satisfaction level of employees and attract and retain the best talent.

Companies that maintain high ethical standards and business practices have better reputations among their competitors and can attract high-quality manpower.

2.6 Maximize Innovation and Adaptability:

ESG investing encourages companies to use their resources more efficiently which can lead to innovative ideas that help companies reduce waste, save energy, lower costs, and remain profitable in the market.

ESG Investing also motivates businesses to take innovative initiatives to increase their profitability and maintain a positive brand image.

The below companies are the good example who adopted ESG principles and achieved business success:

- Apple announced in 2021 that 175 of their suppliers have committed to shifting to renewable energy completely and aims to become carbon neutral by 2030. They’ve also reduced the product’s carbon footprint by 8% by implementing environmentally friendly designs; by switching to the Apple M1 chip in the 13-inch MacBook Pro.

- Google signed contracts for approximately 2.8 GW of clean energy generation capacity in 2022 more than in any prior year, and aims to Run on 24/7 carbon-free energy by 2030.

- Cisco met its goal to source 85% of electricity needs through renewable energy sources in 2021 and committed to carbon emissions 90 percent absolute by 2025.

- Verizon in 2019 was the first US telecom company to issue a green bond, which raised $1 billion in net proceeds.

2.7. Contribution to Global Issue:

Our World is fighting with several global issues like poverty, gender inequality, quality education, etc. In 2015, the United Nations set 17 Sustainable Development Goals (SDGs) to address issues of inequality and protect the planet by 2030.

Companies can directly support ventures that contribute to these global objectives by investing in ESG principles.

For Example, SDG 7 on “affordable and clean energy” can be achieved with investments in renewable energy. Companies that support equal pay will help achieve SDG 10 (reduced inequities) and SDG 5 (gender equality).

😲 Stunning ESG Investing Statistics in 2023

- By 2025, it is expected that ESG investments will have surpassed $50 trillion, substantially doubling since 2016.

- ESG initiatives are in place at 67% of privately owned enterprises and 88% of publicly traded companies.

- In the fourth quarter of 2022, the total assets of sustainable funds worldwide reached $403 billion.

- ESG ETF assets globally have been growing since 2006 and reached a value of $403 billion in November 2022.

- More than half of ESG equity funds have outperformed their category index over the last five years.

- In terms of sustainable assets, Europe is the largest region.

- By 2026, businesses are projected to spend $1.3 trillion on climate-related weather events.

- 53% of revenues of the 500 largest US companies and 49% of revenues of the 1,200 largest global companies come from business activities that support SDGs.

- Up to 60% of operating profits can be impacted by ESG strategies.

Source: wealth pursuits, Bankrate.com,Statista.com, S&P Global.com, and more.

3. What are The 4 Types of ESG Investing Strategies?

There are basically 4 main approaches to ESG investing Trends: Integration, Exclusionary Investing, Inclusionary Investing, and Impact Investing. let’s quickly discuss these strategies one by one.

3.1. ESG Integration:

In this approach, an investor incorporates the ESG pieces of information/metrics into his investment decision to get low-risk enhanced returns.

For example, an Investor can use the ESG integration approach to analyze water usage and toxic emissions with other financial factors to figure out future risks or investment opportunities. Because climate risk can be investment risk.

3.2. Exclusionary Investing:

It means screening out those companies and sectors that have poor ESG performance or are engaged in controversial activities.

For example, by using the Exclusionary Investing approach a potential investor can avoid companies whose revenues are from tobacco, gambling, or fossil fuels.

Exclusionary Investing is also known by other terms like:

- Negative Screening

- Negative Selection

- Socially Responsible Investing (SRI)

3.3. Inclusionary Investing:

The Inclusionary investing approach focuses on investments in specific sectors, industries, or themes with strong ESG characteristics.

This method tries to take advantage of long-term trends and possibilities in environmental and social challenges. Inclusionary Investing is also known by other terms:

- Thematic Investing

- Positive Screening

- Positive Tilt

- Positive Selection

- Best-In-Class

3.4. Impact Investing:

The goal of impact investments is to achieve a positive, measurable social and environmental impact in addition to a financial return.

The aim of Impact Investing is to provide investments in the most pressing sectors such as Healthcare Education Energy, especially clean or renewable energy, and Agriculture.

According to the Forbs, It’s important to note that impact investment is not an act of charity. In contrast, it simply means to gain a return on investment with a positive impact on society and the environment.

4. What are ESG Performance Metrics?

ESG metrics or factors are a set of various performance indicators that help to measure the environmental, social, and governance performance of a business primarily nonfinancial in nature.

These metrics provide valuable insights into things like the internal governance structure, environmental impact, and corporate social responsibility (CSR).

This information can help companies make better decisions about their business practices. Example of ESG Metrics:

1 Environmental Metrics:

- Greenhouse gas emissions.

- Energy management.

- Waste management.

- Water management.

- Toxic substances and pollution.

- Biodiversity loss and protection.

- Deforestation.

2. Social Metrics:

- Employee Diversity.

- Labor practices.

- Employee health and safety.

- Pay equality.

- Human rights and child labor.

- Diversity, equity, and inclusion.

- Data protection and privacy.

- Employee and customer satisfaction.

- Community relations.

- Stakeholder engagement.

3. Governance Metrics:

- Business ethics.

- Remuneration.

- Business Model Resilience.

- Resource Management.

- Tax strategy.

- Supply chain management.

- Risk and crisis management.

4.1. What are Quantitative vs. Qualitative ESG Metrics?

We can Divide ESG metrics into two categories that are Quantitative and Qualitative ESG Metrics based on their calculative nature.

Quantitative ESG Metrics are based on numerical data that can be directly measured and compared. Examples of quantitative ESG metrics include carbon emissions, energy usage, and employee retention rates.

Qualitative ESG Metrics are based on non-numerical data and are difficult to measure and compare for example Diversity commitment, labor practices, and Social impact.

5. What are ESG Reporting Frameworks?

ESG Reporting Frame Work provides the various ESG metrics used to compare the performance of an industry or investment portfolio.

According to Ernst & Young, there are over 600 ESG frameworks and standards exist in 2023 around the world.

But there are two primary reporting frameworks, one is known as GRI and the other is known as ISO is widely used and accepted.

5.1. What is the Difference Between the GRI and ISO?

GRI Stands for Global Reporting Initiative and ISO stands for International Organization for Standardization. Even though both frameworks follow similar principles, ISO concentrates on management transparency while GRI concentrates on the impact of corporate operations.

1. Global Reporting Initiative Framework:

The GRI framework was developed by Nicolas Hulot in 1997. The main focus of this framework is on environmental impacts, climate change, water security, and biodiversity. This framework has been adopted by multiple countries for reporting purposes.

The GRI framework is voluntary but adopted by Over 2,500 organizations including companies like Coca-Cola, Nike, and Walmart.

2. ISO Framework:

ISO is a non-government global organization with the memberships of 165 national standards bodies. The goal of ISO is to bring together specialists to create international standards that will guarantee quality.

Some of the best-known ISO standards relating to Social Governance (ESG) management programs are:

- ISO 9001 is a Quality Management System (QMS) standard that represents the consistency of quality services by organizations

- ISO 14001 is an Environmental Management System (EMS) that minimizes environmental impact while meeting regulatory requirements.

- ISO 14005 provides a framework for SMEs to implement an Environmental Management System (EMS).

- ISO 45001 specifies the framework for a Health and Safety Management System (OHSMS) standard to help organizations improve employee safety, reduce workplace risks, and create safer working conditions.

- ISO 50001 is an Energy Management standard that helps organizations reduce their environmental impact, conserve resources, and improve energy management.

6. How To Differentiate ESG Investing vs. Conventional Investing, ESG vs. Ethical Investing, and ESG vs. SRI Investing?

let’s take a look at the terminologies associated with ESG investing and the differences between them:

- ESG Investing: in this investing approach decision to invest is not only based on Financial factors but also on Environmental, Social, and governance factors. The aim of ESG investing is to earn profit with the contribution to the environment and society.

- Conventional Investing: in the conventional investing approach investment decisions are mostly based upon the financial factors of the company. The aim of this approach is only to make a profit without worrying about the environment and society.

- Ethical Investing: is a similar term used for ESG investing and this approach is more focused on the governance factor of ESG investing.

- SRI Investing: SRI stands for Social Responsible Investing and is more focused on the Social factor of ESG Investing.

7. What are the Top 10 Best Performing ESG Stocks for 2023?

The Top 10 Best performing ESG stocks for 2023:

- 1. Nvidia: is a leading company that deals in GPU and other semiconductors and its 10-year total annualized return to shareholders exceeds 50%.

- 2. Microsoft: is the world’s largest tech company that deals in software production. Microsoft has provided annualized 25% returns to its shareholders over the past 15 years.

- 3. Best Buy: is a top consumer electronic retailer in North America and it gave 16.5% annualized return to its shareholders.

- 4. Adobe: is a well-known IT tech company that provides several software tools, cloud services, and publishing tools. It gave almost 30 % annualized returns over the past 10 years.

- 5. Pool: deals in swimming pool supply to pool builders, contractors, retailers, and companies involved in repairing and maintaining swimming pools. Its 10-year total annualized return is 30%.

- 6. Salesforce: provides Customer Relationship Managment (CRM) software to businesses to help them to manage their customer data and product to boost sales. It has a long history of producing double-digit annual returns for shareholders.

- 7. Cadence: deals in providing specialized software and hardware used in designing PCBs(Printed Circuit boards), ICs, and systems on chips. The annualized return over the past 10 years of cadence is 29%.

- 8. Intuit: The business model of Intuit is providing business accounting services and tax preparation services on a subscription basis. Over the past five years, it delivered 30 % annualized returns to stakeholders.

- 9. Idexx Laboratories: deals in providing diagnostics equipment for pets and livestock. The Earnings per share of this business in 2021 grew 12% year over year,

- 10. Lam Research: supplier of wafer-fabrication equipment and related services to the semiconductor industry. Its 60000 installed-based units are the main competitive advantage.

Source: The Motley Fool

8. What are the Best-Performing ESG Funds in 2023 in the U.S.?

These days ESG ETFs are becoming very popular and are being discussed in the political debate of Washington, D.C. The following are the Top 4 best-performing ETFs as per Forbes.

| Sr.No. | Fund | Expense Ratio | Dividend Yield | Avg. Annual Return Since Inception (September 2018) |

| 1 | Vanguard ESG U.S. Stock ETF (ESGV) | 0.09% | 1.17% | 11.80% |

| 2 | Pimco Enhanced Short Maturity Active ESG ETF (EMNT) | 0.25% | 4.29% | 1.29% |

| 3 | Nuveen ESG Dividend ETF (NUDV) | 0.26% | 2.91% | 0.78% |

| 4 | iShares MSCI Global Sustainable Developmental Goals ETF (SDG) | 0.49% | 1.66% | 8.84% |

Disclaimer 📢

Investing is a complex and dynamic field, and it is essential to approach it with caution and prudence. The information provided in this blog post is for general informational purposes only and should not be considered professional financial advice. Investing in financial markets carries inherent risks, and it is important to do proper research and consult with a qualified financial advisor before making any investment decisions.

9. What are ESG Investing Trends in 2023?

There are seven key areas of ESG Investing Trends to keep a watch on in 2023:

- Climate Change: 90% of climate scientists believe that human activities are responsible for climate change. Companies are recognising that climate change is a significant risk factor. The pressure is maintained by several World regulatory bodies on companies to reduce their carbon footprints. ESG investors who are hopeful about laws addressing climate change can investigate potential investments in alternative energy investments.

- Corporate Governance Change: it is an important factor to watch for ESG investing trends in 2023. Companies are realizing that establishing trust with consumers, investors, and other stakeholders requires good governance. ESG Investors are avoiding investing in those companies whose management is not trustworthy.

- Transitioning Workspace: DIY (Diversity equity and inclusion) is another key trend to watch in 2023. Data shows that companies are acknowledging the importance of creating diverse and inclusive workspaces and implementing various policies to ensure equal pay for equal work.

- Sustainable Investment: Investors are increasingly looking for companies that are committed to ESG principles so trends toward sustainable investment are expected to continue for 2023. Investors are investing in companies that are focused on renewable energy, sustainable products and services, and ethical business practices.

- Regulation aspect: Several world governments and non-government organizations have accepted that climate change is a serious issue and forced companies to adopt a mechanism to reduce their carbon footprint. Like United Nations sets yearly targets to reduce carbon footprints but much more needs to be done in this matter. Governments can take serious action on those who will fail to achieve the target.

- Ethical Innovation in Supply Chain: In 2023, the movement toward ethical supply chains will gain pace. Companies are realizing how crucial it is to make sure that there are no unethical activities, negative environmental effects, or violations of human rights in their supply chains.

- Greenwashing: The act of giving the appearance that a company’s products are ecologically friendly is known as “greenwashing.”Investors must use caution to stay away from businesses that make false claims. If a company’s green marketing efforts are revealed to be fraudulent, it could be charged with greenwashing and suffer penalties, negative news, and reputational harm.

The Final Words:

ESG investing approach is now a widespread trend rather than a specialized method. Investors are becoming more aware of the possibility of achieving financial success while also benefiting the environment and society. ESG evaluates a company’s governance policies, social interactions, and environmental effects. Companies, those taking into account their environmental, social, and governance performance, perform well in the long term and deliver sustainable returns.

FAQs:

Q1. Is ESG Reporting mandatory in the US?

At present, in the US there is no compulsory ESG disclosure required at the federal level. To ensure consistent, comparable, and reliable information for investors regarding the integration of ESG factors by funds and advisers, the US Securities and Exchange Commission (SEC) put forth proposed “amendments to rules and reporting forms” in May 2022.

Q2. What Is the Biggest ESG Event in 2023?

Climate Week NYC: Climate Week NYC will be held from September 17-24, 2023, and will hosted by Climate Group, an international non-profit organization.

- Deloitte at Climate Week NYC 2023: Deloitte is going to be holding from September 18 – September 22 To help enterprises navigate the intricacies of the always-shifting sustainability horizon and make quantifiable progress toward a sustainable future.

- Sustainability Week: Countdown to COP28: The event is going to be held by the COP18 from 2nd October 2023 to 5th October 2023 at Houndsditch, London, UK.

- ESG & Climate Regulation Deep Dive 2023: a virtual event will held on 11 October 2023 by Moody’s Analytics focusing on the ESG regulatory landscape.

Q3. Which Company has the best ESG Strategy:

The organization with the finest ESG strategy will depend on a variety of factors and viewpoints, and this determination is subjective. However, we can give you some information about businesses that have a strong ESG performance. Some of these companies are:

- Microsoft: well-known for its dedication to environmental protection and renewable energy.

- Salesforce.com: is dedicated to environmental sustainability and social responsibility.

- Accenture: is focused on sustainable business practices and social impact.

- Nvidia: has been recognized for its efforts to reduce its carbon footprint and promote energy efficiency.

Q4. Who are the leading ESG institutional investors?

The details of top institutional ESG investors are provided below:

- Public Funds: Of the ESG assets, public funds made up 54%. Pension funds, sovereign wealth funds, and other public investment vehicles are among the funds handled by governmental organizations.

- Insurance companies: 36% of the ESG assets were held by Insurance companies. These businesses make investments in ESG assets to control risks related to climate change and other environmental variables as well as to align their portfolios with their sustainability objectives.

- Educational Institutions: 8% of the ESG assets came from educational institutions. These organizations, which invest in ESG assets to support sustainable development and encourage ethical investing, include universities, colleges, and research foundations.

- Foundations: 1% of the ESG assets were held by foundations. Typically, these foundations are charitable organizations.

Q5. Which Industries are most affected by ESG?

Different industries are significantly impacted by environmental, social, and governance (ESG) concerns. The following are some instances of the sectors most impacted by ESG:

- 1. Fossil Fuels: The fossil fuel sector is highly exposed to each of the three ESG risks. Environmental concerns are very important, including the global switch to green energy and tighter laws. Changing consumer views and damaged community connections are examples of social risks. Transparency for shareholders and a risk management framework are governance risks.

- 2. Finance: Social and governance risks are more important in the financial sector. Companies that provide financing to the fossil fuel sector could indirectly be exposed to environmental hazards. Customer relationships and aggressive or dishonest sales tactics are social dangers. Corporate governance and CEO compensation are included in governance risks.

- 3. Healthcare: Although the specific risks may differ, the healthcare sector is another one that is impacted by ESG variables. Healthcare organizations, for instance, may be exposed to societal hazards relating to patient safety and data privacy. Executive salary and regulatory compliance are examples of governance risks.

These are just a few examples of the industries in which ESG factors have an impact. When reviewing their operations and investment strategies, businesses should take ESG into account because its effects can differ across different industries.

Q6. What is the future of ESG in the US?

Environmental, social, and governance (ESG) investing appears to have a bright future in the US. Over $500 billion was invested in ESG-integrated funds in 2021, which helped to increase the amount of assets under management for ESG-integrated products by 55%. Through 2022 and beyond, it is anticipated that this growth will persist.

Q7. How to Compare Performance of ESG Bussiness?

A company’s ESG performance can be evaluated and compared using ESG ratings, peer comparison, industry benchmarking, and internal data analysis. These techniques aid in determining areas for strength and improvement and serve as a benchmark for assessing an organization’s ESG practices. To make more accurate comparisons between businesses in the shifting ESG landscape, however, worldwide standards and reporting criteria must be established.

Q8. Why is ESG analysis crucial to businesses now?

ESG analysis is a critical tool for businesses to assess their environmental, social, and governance (ESG) practices. It helps identify risks and opportunities related to environmental and social issues, enhancing their reputation and creating long-term value.

Companies that prioritize ESG practices attract investors, customers, and employees who value sustainability and social responsibility. This approach also helps companies comply with regulatory requirements and avoid legal and reputational risks. Thus, ESG analysis is vital for businesses to achieve financial success and contribute to a sustainable future.

Q9. What Will The Impact of ESG by 2025?

According to Bloomberg Intelligence, Global Environmental, Social, and Governance (ESG) assets are projected to exceed $53 trillion by 2025, representing more than a third of the estimated total assets under management.

The pandemic, the green recovery in the U.S., EU, and China, as well as more awareness of ESG potential and dangers, all contribute to this rise. By 2025, ESG assets under management could account for more than a third of the predicted $140.5 trillion worldwide total, assuming a 15% growth rate, which is half the rate of the previous five years.

Q10. What are the 3 essential pillars of ESG?

The three pillars of EGS are Environmental, Social, and Governance:

Environmental: This pillar is concerned with how an organization affects the environment. It includes elements like resource use, waste management, carbon emissions, and ecological sustainability.

Social: The social pillar deals with how an organization affects people, including its staff, clients, and the general public. It includes topics like philanthropy, community involvement, diversity and inclusion, labor policies, and human rights.

Governance: How an organization operates is discussed in the governance pillar. It includes elements like transparency, accountability, moral corporate conduct, risk management, and board makeup.

Q11. Does ESG Investing Out Perform The Market?

There is debate about the performance of ESG investing; some studies claim that ESG companies outperform their peers in terms of stock market returns, while others claim that ESG funds might not perform as well financially. ESG investment takes into account environmental, social, and governance considerations in addition to financial rewards. Investors place a high priority on matching their investments with their values and making a beneficial impact on the environment and society.

Hi nice article