The Cost of Equity is an essential parameter for both companies and investors. If you are unaware of the term “Equity” then take a look at our article i.e. “What is equity in a business” means. A potential investor calculates the cost of equity to understand how much returns he can expect on his investment and determine the relative risk of investing in a company. You may be surprised to know that according to finbox.com current cost of equity of Yandex is 13.25% and google( alphabet) is 10.75%. So here we are going to learn all about the concept of the cost of equity & the cost of equity formula.

1. What Is The Cost Of Equity(Ke)?

When a company needs more funds to expand its business then it could raise funds mainly in two ways. The first way a company can take a loan from a bank is called debt financing for which that company has to pay interest on the loan which is the cost a company has to bear to get a loan.

The second way, a company can raise funds is by selling its equity to the investors, but if an investor is giving his money to that company then he is also owning the risk with shares because, in bonds or preferred stocks, fixed return on investment is predefined

But in the case of shares, no such return could be predefine. If a business will perform well then the share price will rise but if a business will not perform well and go bankrupt then the share price would become zero. Thus due to the involvement of risk in equity financing, it is natural that an investor has some expectation of a minimum rate of return on his investment, and that expected rate of return to a company is equity cost which it has to pay to the investor.

In simple words, Cost of Equity means the rate of returns that a shareholder expects from their investments. It is an essential financial metric used by investors or financial analysts to determine the attractiveness of the stock valuation of a company.

Generally, a low cost of Equity attracts more investors to invest and a lower cost of equity means lower risk. The cost of equity is essential in stock valuation. When an investor invests in a company he expects his investment should increase at least by the equity cost.

Who Calculates The Equity Cost?

Financial professionals such as fund managers, Institutional investors, Banks, and financial analysts use equity cost calculation to make wise investment decisions or earn more rates of returns for their clients.

Individual investors or shareholders use this calculation before investing in a stock to find out the real valuation of a company’s stocks. Periodically, assessing the equity cost can help shareholders make necessary adjustments in their portfolio to achieve financial goals.

A company might calculate its equity cost to make informed business decisions and communicate with potential stakeholders.

2. Formula To Calculate The Equity Cost.

The calculation of the Cost of Equity is not so easy because here we have to calculate the expected returns. There are two types of companies that exist in the market one that pays dividends and the second that doesn’t. So You have to follow two types of approaches to calculate the cost of equity i.e Capital Asset Pricing Model (CAPM) and the Dividend Capitalization Model ( for dividends paid companies).

-

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing model is a bit complex in nature and considers the riskiness of investment relative to the market. This model is less attractive because its calculation is based on historical data but is still used by many financial professionals:

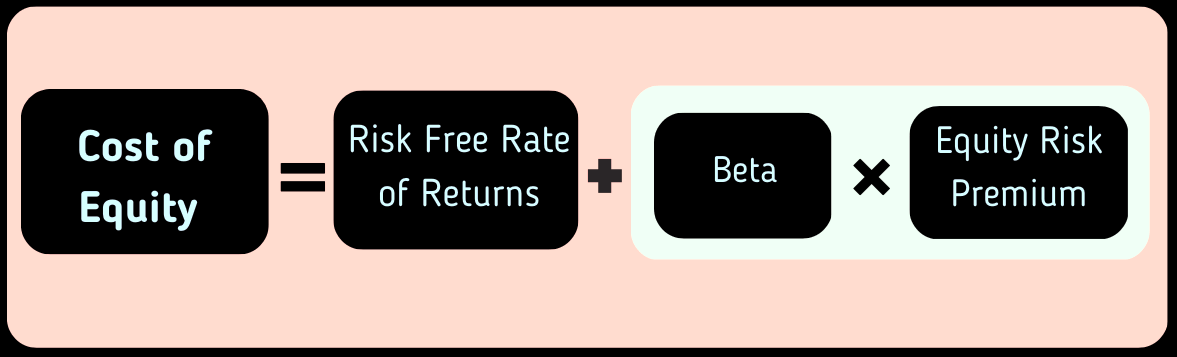

K(e) = Rf + βi * ERP

ERP (Equity Risk Premium) = [E(Rm) – Rf]

Let us understands the components used in the formula:

1. K(e) = Expected return on asset i.

2. Rf = Risk-free rate of return:

The risk-free rate of returns generally refers to the default-free long-term government securities because theoretically, government-issued bonds are viewed as risk-free. You can find the current yield of US 10-year government bonds on various online platforms or news sites like Ycharts, CNBC

3. βi = Beta of asset i :

Beta represents the volatility of specific security and expresses the relationship between the price movement of specific company stock and the overall market. The further risk associated with beta can be divided into 2 parts:

- Systematic Risk:

Systematic risk is also known as Market risk and could also be referred to as “un-diversifiable risk” and it can’t be reduced through diversification because it affects the whole market rather than a single company.

- Unsystematic Risk :

On the other hand, unsystematic Risk is company specific and can be reduced through diversification.

keep in mind that a higher beta means higher equity cost and vice versa.

if βi < 1 then it means Asset ( i ) is less volatile relative to the market.

if βi = 1 then it means the volatility of Asset ( i) is the same as the market volatility.

if βi > 1 then it means the volatility of asset( i ) is more than market volatility.

4. E(Rm) = Expected market return:

The expected market return is typically the average return of the market to which the underlying security belongs over a specific period of time (5 to 10 years).

-

Example to Calculate The Cost of Equity Through CAPM Formula/Model:

Let us take an example of a company XYZ company of which equity cost you want to calculate through the CAPM model. we suppose

- Risk-Free Rate (rf) = 2.5%

- Beta (β) = 1.00

- Expected Market Return E(Rm) = 6.0%

Now apply the formula of CAPM

K(e) = Rf + βi * ERP (ERP = [E(Rm) – Rf])

K(e)= 2.5% +1.00*(6.0% -2.5%)

K(e) = 6%

-

Dividend Discount Model (DDM):

The Dividend Discount Model is used to calculate the cost of equity of dividends paid to companies. Many analysts often use the DDM model while selecting stocks, especially when speculating on future stock prices. Let’s quickly understand the DDM cost of equity formula:

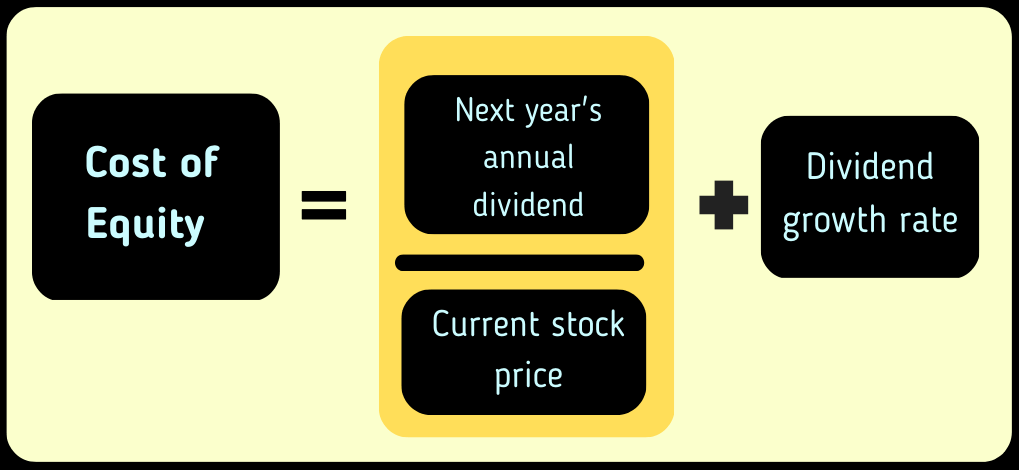

Equity cost = (Next year’s annual dividend / Current stock price) + Dividend growth rate

Here the term ‘Next year’s annual dividend’ means the dividends rate announced by a company on its shares. usually, Companies announce dividends far in advance and such information could be found in the company’s annual/quarterly report or press release.

The current stock price can be easily found on a daily basis from various news sources or online platforms like yahoo finance.

The dividend growth rate is the average growth percentage that a stock’s dividend undergoes for a specific period.

-

Example to Calculate The Cost of Equity Through DDM Formula/Model:

Let us understand DDM through calculation. suppose XYZ Corporation is a company for which you want to calculate the cost of equity by following the Dividend Discount Model.

Suppose its share is currently being traded at $5 and the company has just announced a dividend of $0.50 per share, which will be paid out next year.

Using historical information, you have estimated the dividend growth rate of XYZ Corporation to be 2%.

Now apply the DDM Cost of equity formula and get your result:

Equity cost = (Next year’s annual dividend / Current stock price) + Dividend growth rate

Equity cost = ($0.5/$5)+2% =12 %

3. Relationship Between Cost of Equity and Cost of Capital.

We hope you have clearly understood the concept of cost of equity which means the expected rate of returns that a company has to pay to its shareholder to raise funds by selling its equity.

The cost of capital is the total cost of raising capital, taking into consideration both the cost of equity and the cost of debt. The cost of capital can be calculated by adding the cost of equity and the cost of debt and both must be weighted.

It has been seen that a stable and profitable business will have a lower cost of capital.

4. Cost of Equity Vs Return on Equity.

Many of the new investors may have been confused about the ‘cost of equity’ and ‘return on equity’. Here we are trying to understand the difference between both in very simple words. “Cost of equity” means the rate of return expected by an investor from his investment whereas “Return on Equity” is the actual rate of return got by an investor from his equity investments.

5. Conclusion.

The cost of equity is the expected rate of return that an investor expects from his equity investment. It is an important financial metric used by both professional institutions and retail investors to analyze the valuation of a stock. From a company perspective, it is a cost that has to bear by a company to raise funds through its equity selling. You can calculate the cost of equity through two models i.e.Capital Asset Pricing Model (CAPM) & Dividend Discount Model (DDM). In this article, we tried to explain both The cost of equity formulas in-depth & hope we have added some value to your financial wisdom.