The recessionary gap is a macroeconomic term used to describe an economic situation when the real GDP of a country is lower than its potential GDP. This macroeconomic term helps the individual investor to understand the financial situation of a nation before investment. If the recessionary gap increases, a nation’s economy is heading toward recession. The worse the recession greater the recessionary gap. A recessionary gap occurs when unemployment increases and declines the revenues of industries. So in this article, we are going to explain this macroeconomic term in such a way that even a child could understand it.

1. What is a Recessionary Gap?

To understand the Recessionary Gap you should have an idea about other economic terms such as GDP, actual GDP, and Potential GDP. let’s take a quick look at them:

-

Gross Domestic Product (GDP):

In simpler words GDP means the production of goods and services in a country during a certain period. When people buy more, GDP goes up. When people buy less, GDP goes down.

-

Potential GDP:

Potential GDP refers to the expected level of output when all resources in the economy are fully utilized.

-

Actual GDP:

Actual GDP refers to the actual or current level of output in the economy. It is also known as aggregate demand.

-

Full Employment:

Full employment is an economic situation in which all labor resources of a country are being used in the most efficient way possible. A true full employment situation is ideal and probably unachievable In the real-world context unemployment of 5% or lower is often considered full employment.

2. Defination and Explanation.

It can be defined as the difference between real GDP and potential GDP at full employment and is also known as the contractionary gap. This situation represents the underutilization of resources which puts downward pressure on the prices in long run. Recessionary gaps can be used as an unemployment indicator.

The size of the recessionary gap depends upon many factors including reasons for the recession or the structure and size of the economy. To decrease the size of a recessionary gap, Governments used interest rate cuts and stimulus spending.

When the quantity of labor demanded equals the quantity supplied, then there will be enough job opportunities in a country. When the economy returns to full employment, the recessionary gap closes.

Understanding Recessionary Gap Graph:

The below graph depicts the economic situation when the real GDP is lower than the potential GDP. In the chart below, when the real output is lower than expected the economy faces a recessionary gap. As shown in the figure below, the aggregate demand and SRAS (short-run aggregate supply) intersect at a point left of the LRAS (long-run aggregate supply).

The Outcome of A Recessionary Gap.

The main outcome of a recessionary gap is increased unemployment and such gaps occur because the prices of resources remain relatively constant, as do workers’ wages. In the economic slowdown, the demand for goods and services lowers resulting in an increase in unemployment. If demand is less then a company’s profit may decline or stagnate so it cannot offer higher wages.

For example, during a recession, people spend less, and if demand is less companies produce fewer products and need less workforce so they often fire the staff to cut their expenses.

3. Recessionary Gap Example:

In 2005 the US economy’s real GDP was 17.95 billion compared to a potential GDP of 66.86 billion. You can clearly see that there is a recessionary gap because the potential GPD is higher than the real GDP. In other words, you can say that the American economy has not reached full employment.

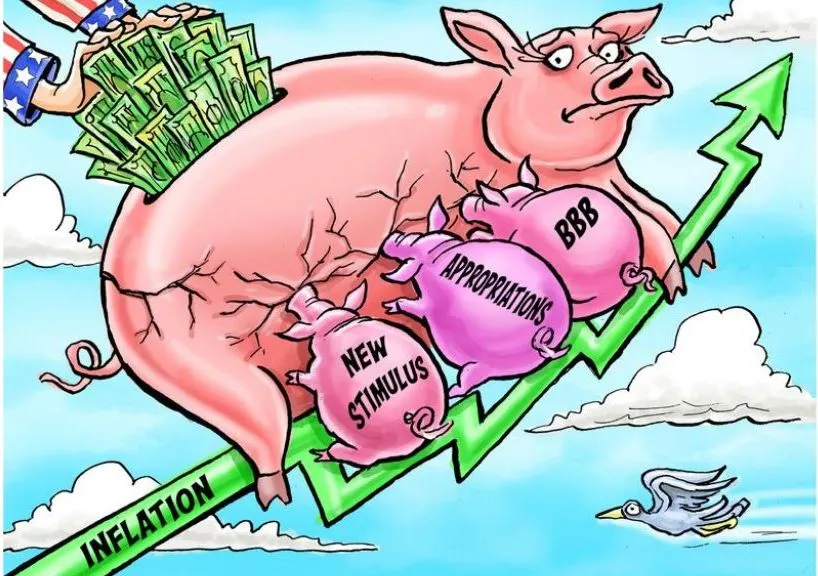

In the year 2020 Unemployment in the USA has risen. In 2020, the GDP of the USA was $20.93 trillion. The unemployment rate in 2020 peaked in April at 14.8% and ended the year at 6.7%. Therefore due to the rise in unemployment, there was an $ 800 billion sizable negative output gap or recessionary gap in the US economy.

4. Recessionary Gap and Exchange Prices.

The recessionary gap has a direct relationship with exchange prices or rates and the currency exchange rate is one of the most important determinants of a country’s relative level of economic health. An exchange rate is the value of a nation’s currency in terms of the currency of another nation or economic zone. To encourage foreign investment Nations might adopt monetary policies to lower rates.

So when a recessionary gap occurs it makes impact a country’s production level and when the production level fluctuates prices of goods and services also change to compensate and may lead to less favorable to the exchange rate. During the recession GDP of a Nation is go down as also its currency value.

This means A lower-valued currency makes a country’s imports more expensive and its exports less expensive in foreign markets.

👉 Read More: Unlock Potential of Cost of Equity Formula in Investing

5. Recessionary Gap vs Inflationary Gap.

We have already stated that we are going to explain this article in such a way that even a child could understand it so we are not going to confuse you with several economic terms so simply let it will be simple.

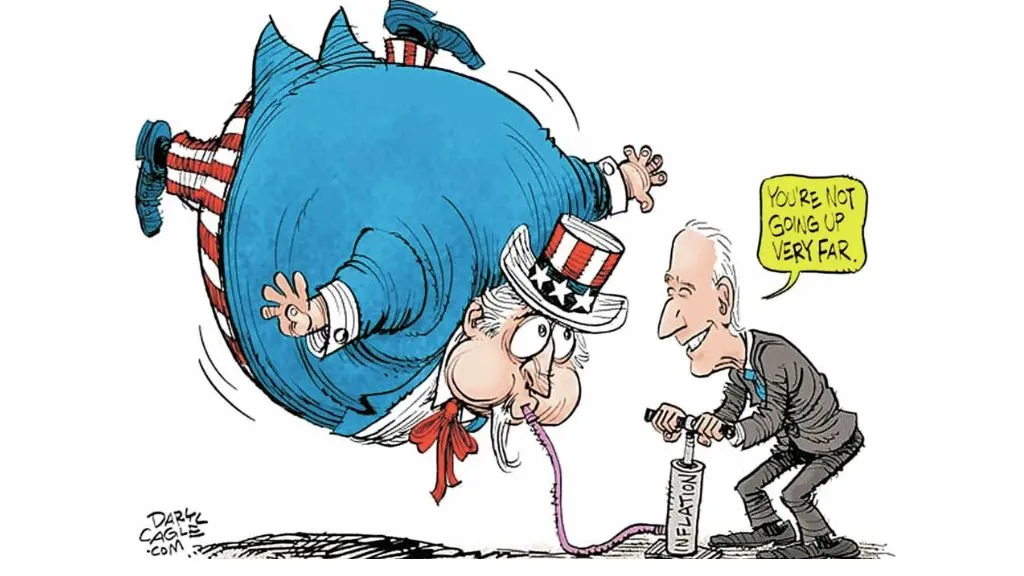

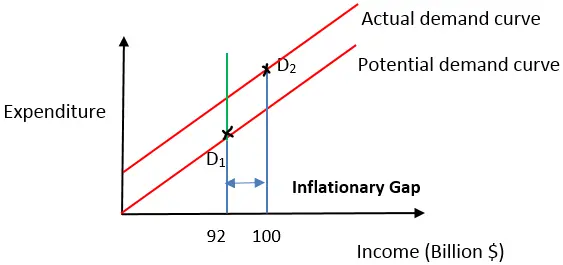

Recessionary Gaps occur when the real GDP of a country is lower than its potential GDP and Inflationary Gap occurs when the real GDP of a country is higher than its potential GDP due to which employers are forced to raise the wage to attract new workers. High wages will decrease the profit of a company and raise the prices of goods or services which means an increase in inflation.

This situation occurs when we make overutilization of our available resources.

6. Conclusion.

In this article, we explained all about the recessionary gap in such a simple way so that everyone could, especially new potential investors could understand the said concept to make a wise decision before investing in a specific company or into a particular country’s economy. We hope our article put some value to your financial wisdom. Please provide your feedback through your comment or email to us.

👉 Read More: Secrets of the Millionaire Mind | 7 Rules of The Rich Vs Poor Mind Set.

-

What is Meant by a Recessionary Gap?

The recessionary gap is a macroeconomic term used to describe an economic situation when the real GDP of a country is lower than its potential GDP. It can also be defined as the difference between real GDP and potential GDP at full employment and is also known as the contractionary gap

-

What is An Example of A Recessionary Gap?

In 2005 the US economy’s real GDP was 17.95 billion compared to a potential GDP of 66.86 billion. You can clearly see that there is a recessionary gap because the potential GPD is higher than the real GDP. In other words, you can say that the American economy has not reached full employment.

-

What is The Inflationary and Recessionary Gap?

Recessionary Gaps occur when the real GDP of a country is lower than its potential GDP and Inflationary Gap occurs when the real GDP of a country is higher than its potential GDP due to which employers are forced to raise the wage to attract new workers. High wages will decrease the profit of a company and raise the prices of goods or services which means an increase in inflation.

-

What Causes a Recessionary Gap?

There are many factors that caused a recessionary gap but there are mainly two. For Example, A slowdown in demand for goods or services and an increase in unemployment, and lower production of goods.

-

What is The Difference Between a Recession and a Recessionary Gap?

Recession refers to a period of slowdown in economic activities depending upon several internal or external factors. Whereas Recessionary gap is a macroeconomic term used to understand an economic situation when the real GDP of a country is lower than its potential GDP. Generally, a recessionary gap occurs when an economy is approaching a recession.

-

How is A Recessionary Gap Fixed?

The recessionary Gap can be fixed by adopting the Expansionary fiscal policy which can close recessionary gaps using either decreased taxes or increased spending.

-

What is The Effect of a Recessionary Gap?

The main effect of a recessionary gap is increased unemployment. When the Recessionary gap expands it means the production of goods and supply is less. if demand is less then a company’s profit may decline or stagnate and the economy of a nation will enter into a recession.

-

Why is a Recessionary Gap Also Called a Negative Output Gap?